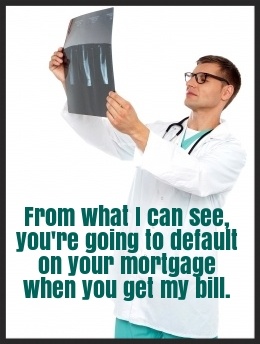

If you guessed that people experiencing foreclosure or the threat of it have a higher incidence of physical and mental health issues including suicide and trips to the emergency room, you guessed right. That's no surprise given the stress of potentially losing your largest investment, moving your family, and having your credit negatively affected. However, you may not have guessed that having an illness is the reason some people go into foreclosure in the first place.

A 2014 study shows that people who had a chronic health condition that worsened as they aged were twice as likely to default on their mortgage and more than two-and-a-half times as likely to fall into foreclosure than people with a chronic condition that did not get worse over time.

The study found that people who got sicker were more likely to lose their job, their income, and health insurance, which made foreclosure more likely. Most people can't make their mortgage payment for long if they don't have a job, no matter the reason for losing it.

And people with a chronic condition who didn't lose their jobs were still at increased risk of defaulting on their mortgage loan. It's thought this is caused by the high medical costs accrued when treating a chronic condition.

No matter what you think the solution is or isn't, the reality is inescapable: healthcare is expensive, and it can cause you to go into foreclosure. It's something that's already happened to many people, and will happen to plenty more.