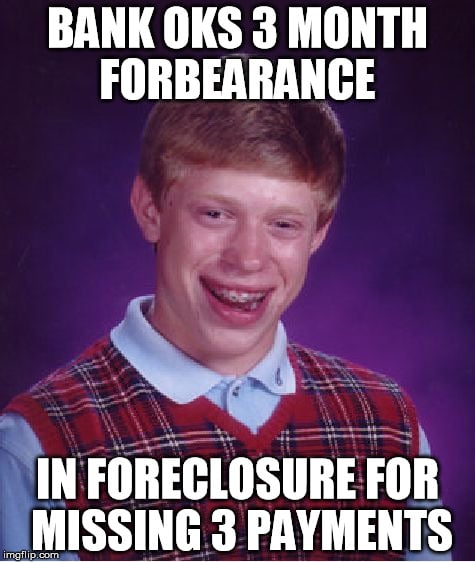

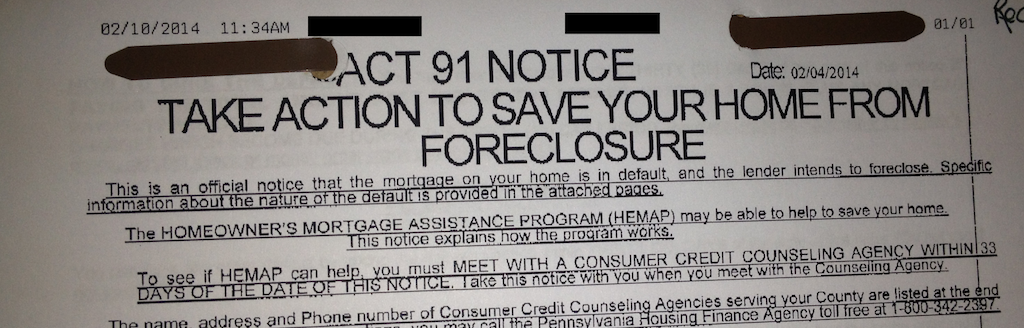

2017's hurricanes are long gone, but some homeowners affected by Irma, Harvey, and Maria are trying to avoid foreclosure after their bank-approved forbearance caused them to end up in foreclosure.

How could that be?

Hurricane Hardships

When hurricane Irma tore through Florida, it knocked out power and damaged property. A lot of people missed work and had to spend extra money on things like home repairs, replacement groceries, fuel for a generator, or a hotel. All the extra expenses made it hard or impossible to pay the mortgage.

Fortunately, many banks offered some assistance to homeowners going through a hurricane-related hardship. Unfortunately, after that temporary assistance ended, some homeowners are finding themselves worse off than before.