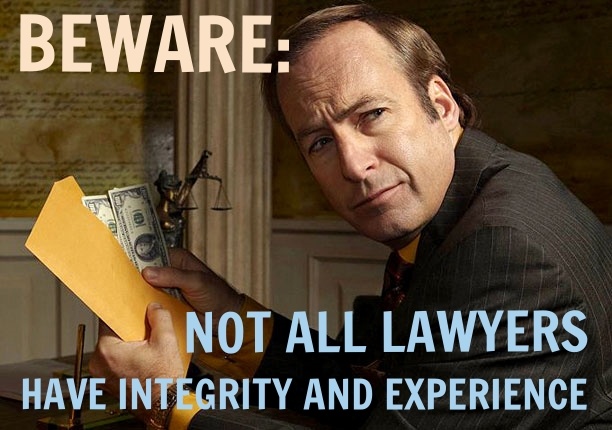

One of the fundamental principles of capitalism is that, if there are a sufficient number of consumers who wish to purchase a product or service, a market will be created to sell it to them. If there's money to be made meeting some need or want, whether it's real or imagined, vital or not, some entrepreneur will provide it and try to turn a profit. We're all grateful that farmers meet our need for food, and Hollywood meets our desire for entertainment (sometimes), and we're happy to hand over our money for those things. But there will always be some entrepreneurs who are intent on making money by deception, or by taking advantage of consumers who wish to purchase a miracle.

Maxwell Swinney

Recent Posts

[fa icon="clock-o"] Monday, October 12, 2015 [fa icon="user"] Maxwell Swinney [fa icon="folder-open'] foreclosure defense, loan modification scams in Florida, Scam Alert

Read More »

Mortgage loans are the cause of more complaints than any other financial product to the Consumer Financial Protection Bureau (CFPB), according to its Monthly Complaint Report for September 2015.

The CFPB has registered 192,500 mortgage complaints, which account for 27% of the total of 702,900 complaints it has received. More than half of all mortgage complaints are related to issues borrowers encounter when they are unable to pay, including problems with foreclosure and loan modification applications.

[fa icon="clock-o"] Friday, October 9, 2015 [fa icon="user"] Maxwell Swinney [fa icon="folder-open'] foreclosure

Read More »

You can't fix a problem you don't know you have, and foreclosure is a very serious problem indeed. Home loans are valuable investments for a lender, and you can bet that if you stop payment on yours, you will be hearing from them asking you where their money is and if you intend to catch up, and eventually telling you to get out so they can sell the property to someone else.

[fa icon="clock-o"] Wednesday, October 7, 2015 [fa icon="user"] Maxwell Swinney [fa icon="folder-open'] foreclosure defense

Read More »

If your home is underwater (worth less than what you owe on it), and you've tried and failed to modify the terms of your loan or come to another agreement with your lender, you may be wondering if it's wise to continue making payments on the property. Is there a way out?

[fa icon="clock-o"] Monday, October 5, 2015 [fa icon="user"] Maxwell Swinney [fa icon="folder-open'] foreclosure defense, strategic default

Read More »

Few people have been more universally hated throughout history than tax collectors. They take your hard-earned money, but it always seems like too much for what the government they represent provides in return. It's a story as old as civilization. Nobody likes paying taxes.

[fa icon="clock-o"] Friday, October 2, 2015 [fa icon="user"] Maxwell Swinney [fa icon="folder-open'] new jersey foreclosure attorney, florida foreclosure defense, pennsylvania foreclosure defense, illinois foreclosure lawyer, foreclosure defense, new york foreclosure attorney

Read More »

Americans love to envy the lavish lifestyles of celebrities when they are on top, and to witness their fall from grace. Despite having tremendous wealth and the love and admiration of millions of people, movie stars, musicians, professional athletes, and other famous or infamous people, have found themselves in the same situation as many regular Americans. That is, unable to make their mortgage payments and threatened with foreclosure by the bank.

[fa icon="clock-o"] Wednesday, September 30, 2015 [fa icon="user"] Maxwell Swinney [fa icon="folder-open'] foreclosure defense

Read More »

Foreclosure is a major crisis for the people who experience it. It's something you never thought would happen, otherwise you would not have taken out a mortgage loan. You may feel that you need the help of an attorney, but deciding what type, and who among them you should hire is no easy task.

[fa icon="clock-o"] Monday, September 28, 2015 [fa icon="user"] Maxwell Swinney [fa icon="folder-open'] foreclosure defense

Read More »

Rejection hurts. If you're like many people whose application for a mortgage loan modification has been denied, you don't know what to do. Should you rip the copper pipes out of your house, leave town and start a new life in Mexico, singing songs for loose change in sleepy tequila joints? Before you make that decision, remember that you can reapply for a loan modification.

[fa icon="clock-o"] Friday, September 25, 2015 [fa icon="user"] Maxwell Swinney [fa icon="folder-open'] loan modification, mortgage modification

Read More »

Believe it, or not, your mortgage lender is interested in the hardships you've endured that have led you to seek better terms on your mortgage loan. In fact, if you are facing foreclosure and looking for a loan modification, a letter explaining the hardships you've experienced is required.

[fa icon="clock-o"] Monday, September 21, 2015 [fa icon="user"] Maxwell Swinney [fa icon="folder-open'] loan modification, write a hardship letter, hardship letter

Read More »

Times are tough. The effects of the recession and housing crisis have left you in a less-than-ideal financial situation, and now you're having trouble making your mortgage payments. You may be thinking about trying to get a loan modification to lower your interest rate, or you may be worried that a foreclosure is in your future. You know that if a loan modification is successful, your monthly payments could be reduced to a more manageable level. You also know that your chances of getting a loan modification approved without an attorney are slim, but you don't know if you can afford an attorney.

Alternatively, you may think the result is a forgone conclusion, and that there is no point in paying an attorney to tell you what you already know, that you're going to lose your home.

[fa icon="clock-o"] Friday, September 18, 2015 [fa icon="user"] Maxwell Swinney [fa icon="folder-open'] stop foreclosure, foreclosure defense

Read More »