Americans love to envy the lavish lifestyles of celebrities when they are on top, and to witness their fall from grace. Despite having tremendous wealth and the love and admiration of millions of people, movie stars, musicians, professional athletes, and other famous or infamous people, have found themselves in the same situation as many regular Americans. That is, unable to make their mortgage payments and threatened with foreclosure by the bank.

Americans love to envy the lavish lifestyles of celebrities when they are on top, and to witness their fall from grace. Despite having tremendous wealth and the love and admiration of millions of people, movie stars, musicians, professional athletes, and other famous or infamous people, have found themselves in the same situation as many regular Americans. That is, unable to make their mortgage payments and threatened with foreclosure by the bank.

While celebrities do often get special treatment, when they stop making their monthly mortgage payments, their lender does not care how famous they are, who likes them, or what they've gotten away with in the past. The rich and famous are served foreclosure papers just like your average Joe Six-Pack. Below are of some of the notable celebrities who have experienced foreclosure:

Burt Reynolds, actor: Foreclosure papers were filed in 2011 on Reynolds' 153-acre Burt Reynolds Ranch and home in Florida. Scenes from 'Smokey and the Bandit' were filmed at the property, which featured a petting zoo at one time. The ranch was sold during bankruptcy and rezoned for residential development.

Terrell Owens, former NFL player: Despite earning more than $80 million over the course of his career, the former receiver has not been able to score a touchdown with his investment portfolio. The controversial star sold two condos he owned in a short sale and had two others repossessed by the bank after they fell substantially in value.

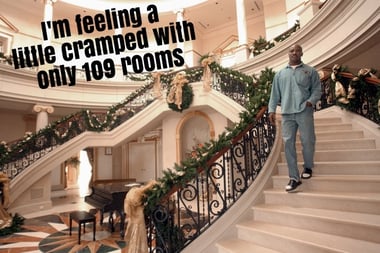

Evander Holyfield, boxer. The former undisputed world champion found out that the bank was "The Real Deal" when they foreclosed on his his enormous 54,000-square foot, 109 room, 17 bathroom Georgia home in 2008. If splurging for 109 rooms wasn't extravagant enough, consider that Holyfield was also taken to court for $550,000 in unpaid debt for landscaping. The home was sold at auction in 2008 and Holyfield moved out, hopefully to a home that doesn't have rooms that number in the triple digits.

Rihanna, singer: The pop star defaulted on a $6.9 million loan for her Beverley Hills home after it suffered from water damage, then sold it in a short sale for a $2 million loss. The “Diamonds” singer blamed her accountants for mismanaging her finances.

Michael Jackson, singer: The King of Pop earned an estimated $750 million over the course of his career, but uncontrolled spending and poor planning left him with hundreds of millions in debt and on the verge of losing his 2,800-acre Neverland Valley Ranch in Santa Barbara, California. The ranch featured Disney-themed amusement park rides, a private zoo, and a large home. The cost of maintaining the property was $10 million a year. Jackson was able to avoid foreclosure, and being forced to “Beat It” out of Neverland, by taking a $25 million loan from a private equity firm.

R. Kelley, musician: The Grammy-winning “I Believe I Can Fly” singer's lavish Illinois home was purchased in 1999 with a $3.5 million loan. When the home's value dropped more than $1 million in just one year, Kelley moved out and stopped making payments. The property eventually sold to a bank for $950,000.

Celebrities find themselves with a mortgage they can't afford for the same reasons as everyone else: they get a home loan at a time when their career is going well and they have money to spare, then their income suffers, but their mortgage payment stays the same, and they can't afford to make it anymore.

No matter who you are, or what you do for a living, if you fall behind on your mortgage payments, you need the assistance of a professional to defend yourself from foreclosure. It's probably safe to assume that the famous people listed above hired an experienced attorney to achieve the best outcome for them. Often, a deal can be reached that benefits all parties. People who have been served foreclosure papers have kept their homes with modified loans or repayment plan agreements. If the home cannot be saved, short sale or deed-in-lieu of foreclosure agreements can be reached that make the best of a bad situation.

Whether you're used to the champagne and caviar lifestyle, or a less glamorous one, the assistance of an attorney who understands your difficulties and the options available to ease them, is invaluable. An experienced foreclosure defense law firm can help you find the best solution to your mortgage problems.