Disclaimer: these results should not be construed as a guarantee, as each case is unique. We have helped over 5,000 homeowners, here is one of their stories. A mature, single Florida homeowner was having difficulties making her mortgage payment, because of limited income from social security. She was even renting out one of her bedrooms. It just wasn't enough to make ends meet. When she retained our law firm, she hadn't paid her mortgage in over 10 months, she owed her lender—Nationstar Mortgage—over $8,000 dollars, and her home was in the foreclosure process. No foreclosure sale date had been set yet.

A mature, single Florida homeowner was having difficulties making her mortgage payment, because of limited income from social security. She was even renting out one of her bedrooms. It just wasn't enough to make ends meet. When she retained our law firm, she hadn't paid her mortgage in over 10 months, she owed her lender—Nationstar Mortgage—over $8,000 dollars, and her home was in the foreclosure process. No foreclosure sale date had been set yet.

Jake Sterling

Recent Posts

[fa icon="clock-o"] Saturday, July 13, 2013 [fa icon="user"] Jake Sterling [fa icon="folder-open'] loan modification attorney, loan modification, successful loan modifications

Read More »

Pets Left Behind and Forgotten – Victims of Foreclosure

They can't speak for themselves: poor defenseless animals abandoned and left behind in foreclosed homes. It's a bigger issue than people realize, a serious consequence of the foreclosure nightmare.

Many homeowners do consider turning their pets into animal shelters, but due to overpopulation at many shelters, almost half of incoming animals are euthanized. Heartless homeowners sometimes leave pets in their abandoned homes without food or water, not to mention a non-temperature-controlled environment. Veterinarians say a dog or cat will become dehydrated within 24 hours without water and could die a slow, painful death within a few days.

Why or How Can Foreclosed Homeowners Abandon Pets?

[fa icon="clock-o"] Friday, July 12, 2013 [fa icon="user"] Jake Sterling [fa icon="folder-open'] stop foreclosure

Read More »

- Do you know what to do after being served with a foreclosure notice?

- Do you understand how long foreclosure takes in Pennsylvania?

- Are you prepared to confront every twist and turn of Pennsylvania's foreclosure process?

[fa icon="clock-o"] Wednesday, July 10, 2013 [fa icon="user"] Jake Sterling [fa icon="folder-open'] pennsylvania foreclosure defense

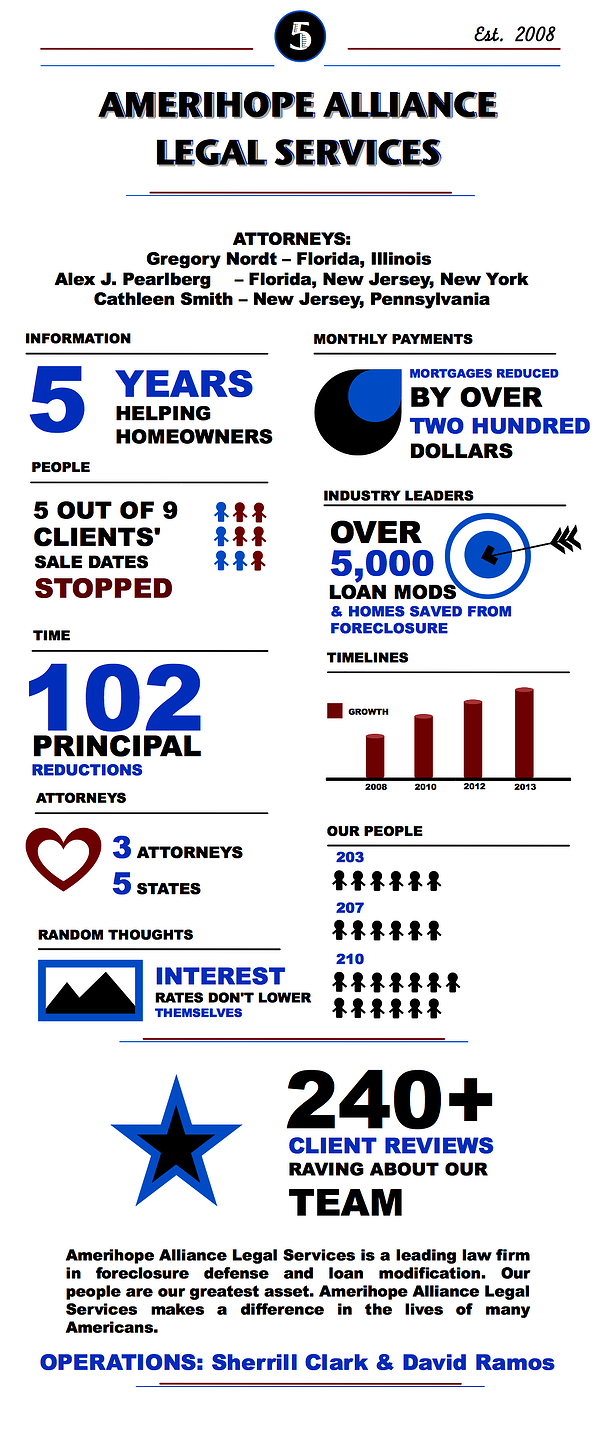

Read More »In 5 years, Amerihope Alliance Legal Services has accomplished a LOT. We have completed over 5,000 loan modifications for our clients, stopped countless foreclosures. Many homeowners are back on their feet because they chose to retain the foreclosure defense lawyers at our firm.

Click through to see the graphic.

[fa icon="clock-o"] Monday, July 8, 2013 [fa icon="user"] Jake Sterling [fa icon="folder-open'] loan modification, foreclosure defense

Read More »

To celebrate our 5 year anniversary, we ran a contest in the office. Employees were invited to submit a poem, story, song or picture. Here are our winners!

Winner: Ruth Gross

There was a nice woman

Who lived in a shoe,

She had so many bills,

She didn't know what to do.

She went to Amerihope

With her fears and her dreams,

And with a smile and some work,

They saved her home that sat by a stream.

Her family is now happy

And is able to cope.

She said, "Thank you Lord,

For sending me to Amerihope"

She then kissed all her children

And made sure they were fed

And when they were done,

She tucked them all in bed.

Runner Up: Joe Mizzell

Amerihope Mod Song

[fa icon="clock-o"] Friday, July 5, 2013 [fa icon="user"] Jake Sterling [fa icon="folder-open'] bank of america loan modification, loan modification, foreclosure defense

Read More »

- Do you know what's the first step to take after receiving a foreclosure notice?

- Do you know how long the foreclosure process takes in Illinois?

- Do you know what to expect from the foreclosure process?

If you answered “no” to any of these questions, then you should invest 2 minutes into downloading the Illinois foreclosure timeline, especially if you are at risk for foreclosure or if you are already within the foreclosure process.

[fa icon="clock-o"] Wednesday, July 3, 2013 [fa icon="user"] Jake Sterling [fa icon="folder-open'] illinois foreclosure lawyer

Read More »Every Homeowner In Your State Deserves a Homeowner Bill of Rights. Here's Why.

California was once one of the worst places to experience foreclosure, but now it is a model state for giving homeowners a a fair shake against their mortgage lenders. One single piece of legislation is responsible for this change; that legislation is the Homeowner Bill of Rights. California's Homeowner Bill of Rights formally took effect at the beginning of 2013. According to the California Attorney General's Office, the Bill of Rights "ensures fair lending and borrowing practices for California homeowners... these laws are designed to guarantee fairness and transparency for homeowners within the foreclosure process."

California was once one of the worst places to experience foreclosure, but now it is a model state for giving homeowners a a fair shake against their mortgage lenders. One single piece of legislation is responsible for this change; that legislation is the Homeowner Bill of Rights. California's Homeowner Bill of Rights formally took effect at the beginning of 2013. According to the California Attorney General's Office, the Bill of Rights "ensures fair lending and borrowing practices for California homeowners... these laws are designed to guarantee fairness and transparency for homeowners within the foreclosure process."

[fa icon="clock-o"] Monday, July 1, 2013 [fa icon="user"] Jake Sterling [fa icon="folder-open'] loan modification, foreclosure defense

Read More »By Alex J. Pearlberg, Esq.

So imagine you are behind in your FHA- backed mortgage, the property is way upside-down and you wish to exercise all of your loss mitigation options. As the homeowner, you have submitted all of the documents required by the servicer on your loan. Bank of America (BOA) and you have been denied for a HAMP loan modification. You have had the property listed for sale for over nine (9) months and have yet to receive an offer at anywhere close to the market value, much less the balance on the loan. BOA has sent numerous letters indicating there may be other alternatives, including a deed in lieu of foreclosure and monetary help in relocating. After thinking long and hard, you have decided to give up your homestead and surrender the property to the lender by way of a deed in lieu. One problem: BOA now indicates that “due to recent changes in FHA guidelines you must submit and proceed through the BOA short sale process and department.”

[fa icon="clock-o"] Friday, June 28, 2013 [fa icon="user"] Jake Sterling [fa icon="folder-open'] florida foreclosure defense, bank of america loan modification problems, bank of america foreclosure

Read More »

For Immediate Release - Plantation, FL - June 18, 2013

Law firm Amerihope Alliance Legal Services masters the art of foreclosure defense, helping over 5,000 homeowners expands its reach to helping homeowners in five judicial states.

Amerihope Alliance Legal Services, located in Plantation, Florida, started out as a law firm dedicated to helping Florida's homeowners fight foreclosure against the banks. During the last several years due to their vast experience in the judicial foreclosure process they have added four additional judicial states: New York, New Jersey, Pennsylvania and Illinois.

As of June 2013, over 5,000 (five thousand) loan modifications have been completed by Amerihope Alliance Legal Services. 5,000? What is their secret?

[fa icon="clock-o"] Wednesday, June 26, 2013 [fa icon="user"] Jake Sterling [fa icon="folder-open'] loan modification lawyer, foreclosure defense, loan modification help

Read More »

For most facing foreclosure either now or in the future, something has changed in their lives that is already causing more than enough stress without any help from the looming loss of their home. Many find that their change in circumstances leaves them unable to make monthly mortgage payments, and they face foreclosure simply because they don’t know what they need to do or how to go about it. When you interview lawyers to help keep your home, you might feel lost. What should be the cost of foreclosure defense?

[fa icon="clock-o"] Friday, June 21, 2013 [fa icon="user"] Jake Sterling [fa icon="folder-open'] new jersey foreclosure attorney, florida foreclosure defense, pennsylvania foreclosure defense, illinois foreclosure lawyer, foreclosure defense, new york foreclosure attorney

Read More »