[fa icon="clock-o"] Thursday, July 10, 2025 [fa icon="user"] Jake Sterling [fa icon="folder-open'] stop foreclosure, loan modification lawyer, loan modification attorney, loan modification, foreclosure defense, loan modification help, foreclosure, mortgage, foreclosure glossary, lawyer, foreclosure crisis, foreclosure defense attorney, avoiding foreclosure, loan modification application

Read More »

A successful relationship between a client and a law firm requires both parties to do their job. The firm may have the most work to do, but there are some things that only the client can do. Even the greatest attorney in the world can't get you what you want if you're not playing ball.

If you hire our law firm, take the steps below to ensure that you have the best relationship with us and the highest chance of getting the outcome you want.

1. Add our phone numbers to your contacts and return our calls.

Have you ever received a call from an unknown number and not answered it because you assumed that if the caller was important to you, you'd already have their number saved in your phone? Probably a telemarketer, you figured. Then you get a voice mail and realize that the caller was someone very important to you, but you didn't add their number to your contacts yet. Crap!

Don't let that happen with a call from your lawyer. Add our number to your contacts and answer when we call you -- it's probably important. If you're a client of our firm, you will be getting calls from 877-882-5338 and 866-558-2408. You might also want to add your paralegal's direct fax number, so you have it handy while you're doing #3 below.

[fa icon="clock-o"] Tuesday, January 30, 2024 [fa icon="user"] Jake Sterling [fa icon="folder-open'] loan modification, foreclosure defense attorney

Read More »

A loan modification can allow you to keep your home and avoid foreclosure after falling behind on your mortgage, but it's not necessarily all roses. In fact, there are some downsides to loan mods that your lender may not go out of their way tell you about.

If you don't know, a loan modification is a permanent change to one or more of the terms of your mortgage, such as the term, interest rate, and monthly payment.

A loan modification is often the only hope many homeowners have to keep their home following a default. They can be great, however if you need one, you should be aware of the following:

[fa icon="clock-o"] Sunday, July 12, 2020 [fa icon="user"] Jake Sterling [fa icon="folder-open'] loan modification, loan modification help

Read More »

Amerihope Alliance Legal Services, which focuses on providing foreclosure defense and loan modification assistance, is proud to have accepted numerous awards for providing excellent service to our clients over the last 12 years.

[fa icon="clock-o"] Thursday, July 9, 2020 [fa icon="user"] Maxwell Swinney [fa icon="folder-open'] loan modification, law firm awards, foreclosure

Read More »

If you tell people that you're trying to get a loan modification to avoid foreclosure and keep your home, inevitably some of them will offer advice, whether they know what they're talking about or not.

Acting on bad guidance for something so important can be harmful to your chances of getting the outcome you want.

Here's some of the worst advice we've heard about loan modifications and foreclosure:

"Stop paying your mortgage to get a loan mod"

Homeowners who are current on their mortgage have been told that they need to stop paying their mortgage to be eligible for a loan modification.

This is wrong.

You do need to show that you've had a hardship that's making it hard to afford your mortgage, but you do not have to be in default to get a loan modification.

[fa icon="clock-o"] Friday, April 19, 2019 [fa icon="user"] Jake Sterling [fa icon="folder-open'] loan modification, foreclosure

Read More ».png)

Disclaimer: These results should not be taken as a guarantee, as each case is unique. We have helped over 7,000 homeowners. Here are some of their stories.

Every week we obtain loan modifications for our clients with a variety of loan servicers. You can see these results as they are announced on Twitter (#loanmodwow) or Facebook. Here are some of our results from this week with Freedom, Seterus, Wells Fargo and SPS:

[fa icon="clock-o"] Friday, March 8, 2019 [fa icon="user"] Jake Sterling [fa icon="folder-open'] wells fargo loan modification, loan modification, successful loan modifications, sps loan modification, seterus loan modification, sps repayment plan, freedom mortgage loan modification, loan modification success

Read More »

You did the hard work of applying for a loan modification and making your trial modification payments. Congratulations!

After making that last trial payment, the only thing to do is wait for the bank to send you a final modification offer, then you can finally put your foreclosure nightmare behind you forever and move on with life. Right?

Unfortunately, your permanent modification offer may not come right away. Why is that?

Applying For A Loan Modification

Applying for a loan modification is no easy task. You have to submit a package of documents called a Request for Mortgage Assistance or RMA. Often the servicer will require the homeowner to continually resubmit newer versions of the same documents such as bank statements while the application is under review.

[fa icon="clock-o"] Wednesday, March 6, 2019 [fa icon="user"] Jake Sterling [fa icon="folder-open'] loan modification, foreclosure, trial modification

Read More »

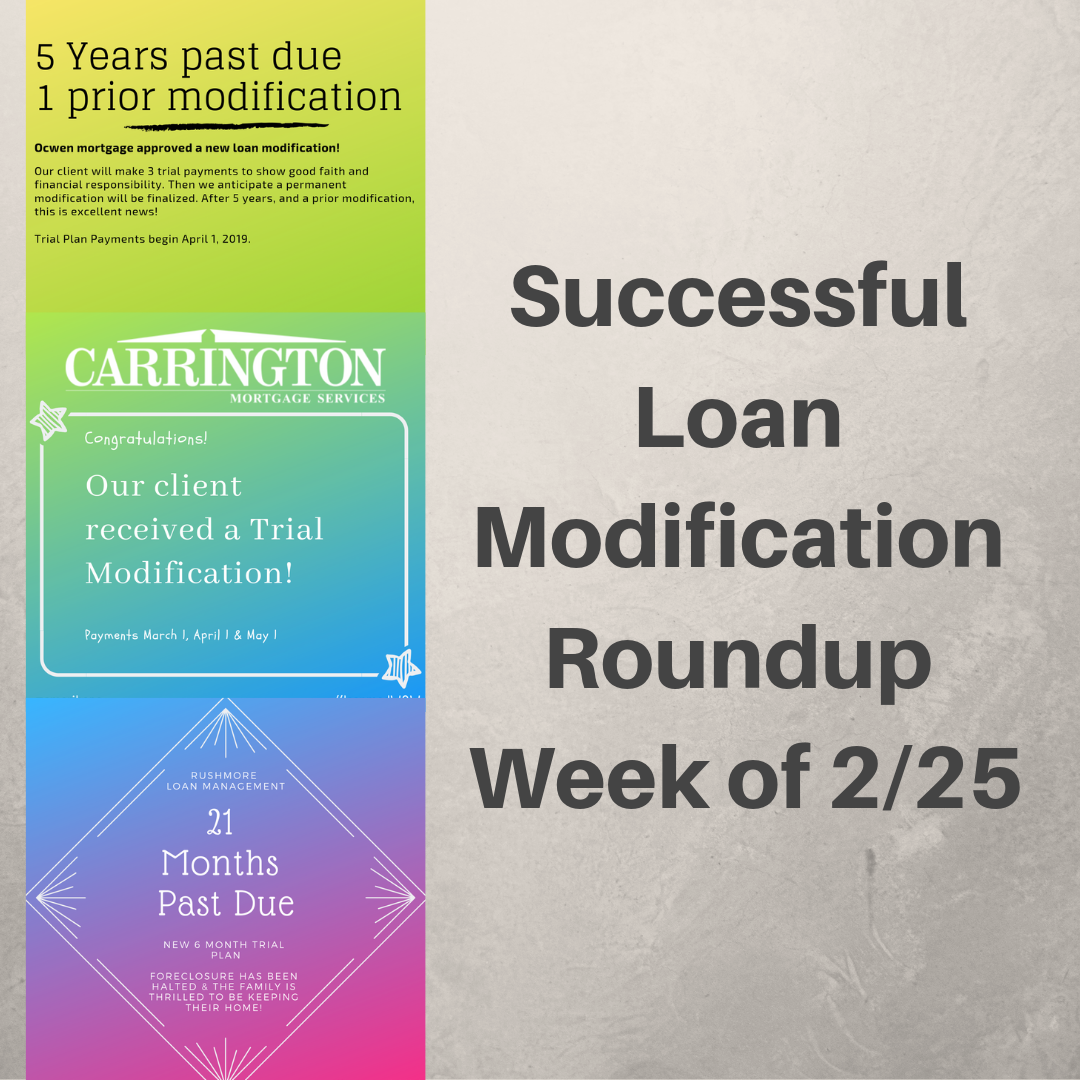

Disclaimer: These results should not be taken as a guarantee, as each case is unique. We have helped over 7,000 homeowners. Here are some of their stories.

Every week we obtain loan modifications for our clients with a variety of loan servicers. You can see these results as they are announced on Twitter (#loanmodwow) or Facebook. Here are some of our results from this week with Ocwen Mortgage & Carrington:

[fa icon="clock-o"] Friday, March 1, 2019 [fa icon="user"] Jake Sterling [fa icon="folder-open'] loan modification, successful loan modifications, ocwen loan modification, carrington loan modification, Rushmore loan modification, loan modification success

Read More »

Disclaimer: These results should not be taken as a guarantee, as each case is unique. We have helped over 7,000 homeowners. Here are some of their stories.

[fa icon="clock-o"] Friday, February 22, 2019 [fa icon="user"] Jake Sterling [fa icon="folder-open'] i have a foreclosure sale date, loan modification, successful loan modifications, carrington loan modification, loan modification success, mr cooper loan modification

Read More »

Disclaimer: These results should not be taken as a guarantee, as each case is unique. We have helped over 7,000 homeowners. Here are some of their stories.

Every week we obtain loan modifications for our clients with a variety of loan servicers. You can see these results as they are announced on Twitter (#loanmodwow) or Facebook. Here are some of our results from this week with Freedom Mortgage, Flagstar Mortgage, Shellpoint Mortgage, and SPS:

Freedom Mortgage

After falling $43,594.86 and 28 months past due on her mortgage, we helped our Freedom Mortgage client get a three month Ginnie Mae trial loan modification plan with a fresh start!

[fa icon="clock-o"] Friday, February 15, 2019 [fa icon="user"] Maxwell Swinney [fa icon="folder-open'] loan modification, sps loan modification, shellpoint loan modification, freedom mortgage loan modification, flagstar loan modification, loan modification success

Read More »