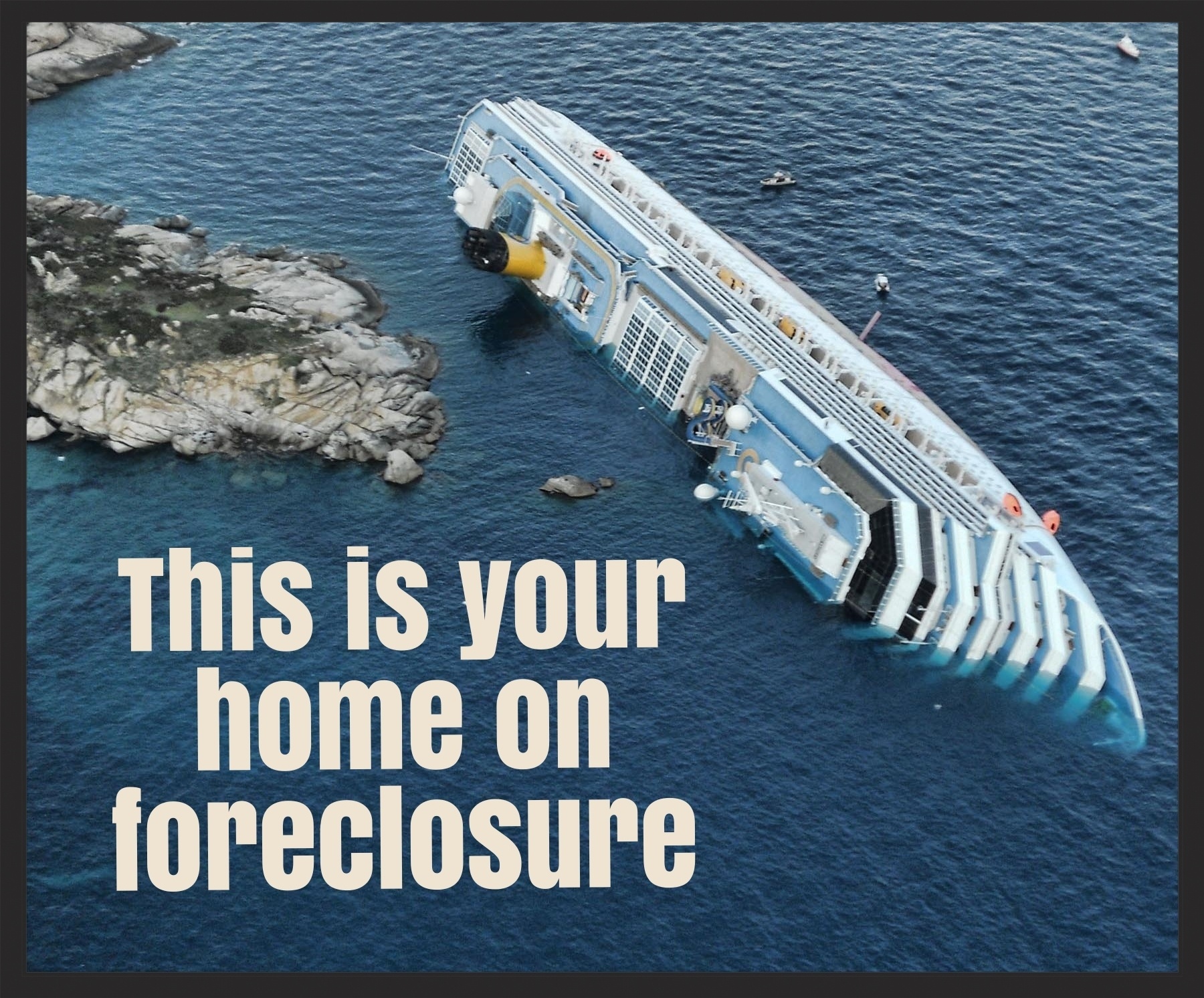

As the saying goes, you win some and you lose some. In the case of a foreclosure lawsuit, if the homeowner “loses” the bank gets to keep the house. And when the bank keeps the house, the homeowner gets booted out. The bank, or new owner, must give homeowners notice before eviction can take place. Even so, the homeowner bears the moving expenses. These expenses can be difficult to cover, especially in the wake of the financial hardship that led to foreclosure.

Are there any options for homeowners in this situation?