Normally people fall into foreclosure because they don't have enough money to pay their mortgage. But sometimes it's a mistake from the mortgage servicer, not any fault of the borrower, that puts someone into foreclosure. That's the case for a recent client of our firm, who I'll call Ms. Craig to protect her privacy.

Ms. Craig is a school teacher who has owned a home near Chicago, Illinois since 2002. For nearly a decade and a half things went pretty smoothly with her home and finances.

Then in 2016, Ms. Craig filed for Chapter 7 bankruptcy to deal with some debt that was not related to her mortgage. Her home was not included in the bankruptcy and she continued to make her mortgage payments during bankruptcy.

Mortgage Servicer Changed

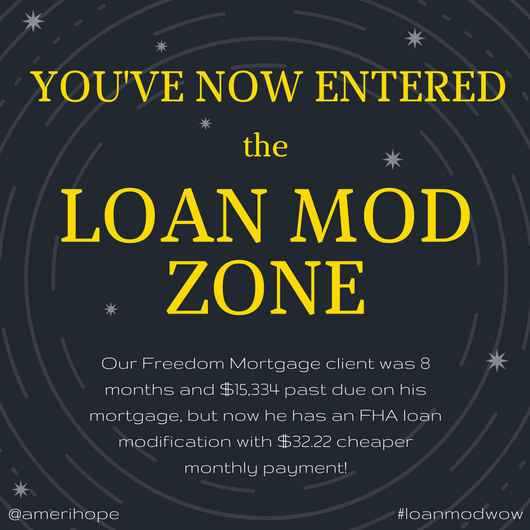

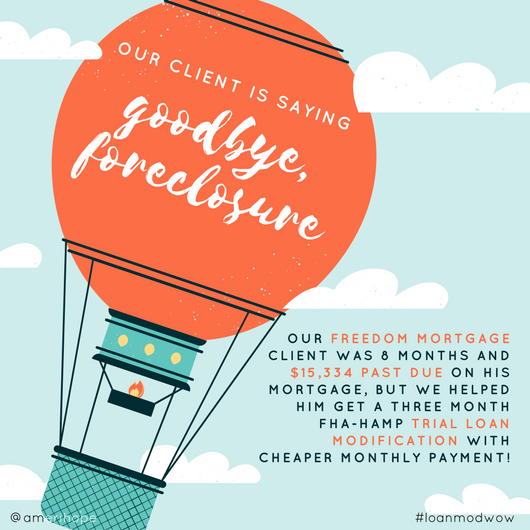

Also in 2016, the servicing rights to Ms. Craig's mortgage were transferred from Loan Care to Freedom Mortgage. It's a servicer's right to sell the servicing rights to another company if they wish, and the borrower has no say in it.

Servicing is supposed to continue as normal during and after the transfer, but that's not what happened in Ms. Craig's case.

.png)