21st Mortgage

Our client was in foreclosure and 14 months past due to 21st Mortgage. We got them a fresh start with a final loan modification and a low fixed interest rate!

Disclaimer: These results should not be taken as a guarantee, as each case is unique. We have helped over 7,000 homeowners, here are a few of their stories.

Every week we obtain loan modifications for our clients with a variety of loan servicers. You can see these results as they are announced on Twitter (#loanmodwow) or Facebook. Here are some of the results from this week, which includes results from Caliber, SPS, and others:

Our client was in foreclosure and 14 months past due to 21st Mortgage. We got them a fresh start with a final loan modification and a low fixed interest rate!

[fa icon="clock-o"] Friday, July 29, 2016 [fa icon="user"] Maxwell Swinney [fa icon="folder-open'] loan modification, successful loan modifications, ocwen loan modification, sps loan modification, caliber loan modification, asc loan modification

Read More »

Disclaimer: These results should not be taken as a guarantee, as each case is unique. We have helped over 7,000 homeowners, here are a few of their stories.

Every week we obtain loan modifications for our clients with a variety of loan servicers. You can see these results as they are announced on Twitter or Facebook. Here are some of the results from this week, which includes results from Ocwen, Bank of America and others:

Our client was in foreclosure, 11 months and $18K past due with Carrington, but we got them a trial modification with a $208 cheaper payment and a fresh start!

[fa icon="clock-o"] Friday, July 22, 2016 [fa icon="user"] Maxwell Swinney [fa icon="folder-open'] bank of america loan modification, loan modification, successful loan modifications, ocwen loan modification, principal reduction, carrington loan modification

Read More »

Disclaimer: These results should not be taken as a guarantee, as each case is unique. We have helped over 7,000 homeowners, here are a few of their stories.

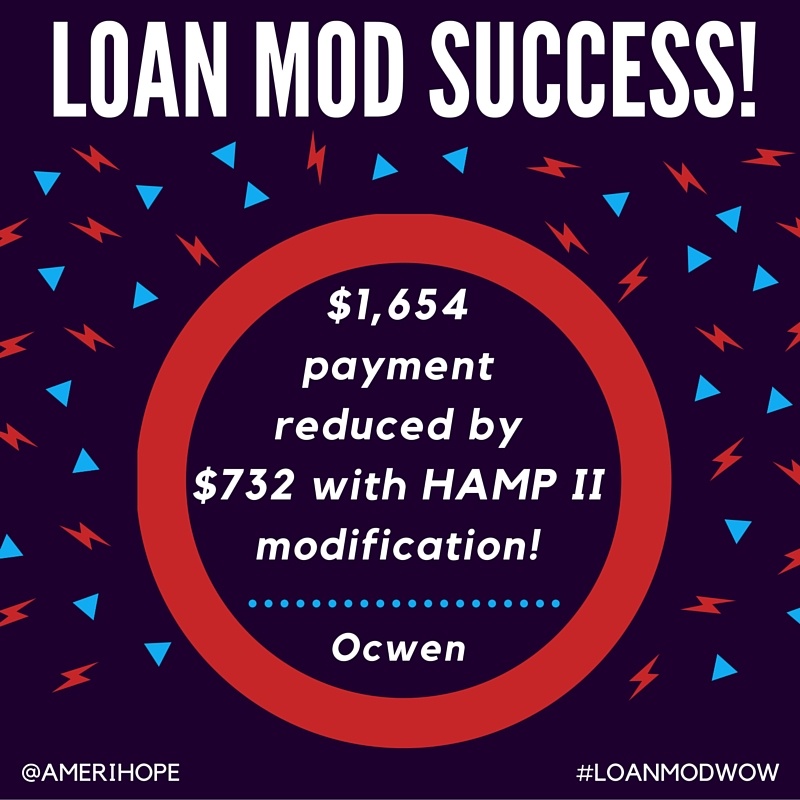

Every week we obtain loan modifications for our clients with a variety of loan servicers. You can see these results as they are announced on Twitter or Facebook. Here are some of the results from this week, which includes results from Ocwen, Seterus, and others:

Our client was behind on their $1,654/month payment to Ocwen, we got them a HAMP II trial loan modification with a $732 cheaper payment!

[fa icon="clock-o"] Friday, July 15, 2016 [fa icon="user"] Maxwell Swinney [fa icon="folder-open'] loan modification, successful loan modifications, ocwen loan modification, sps loan modification

Read More »

Disclaimer: These results should not be taken as a guarantee, as each case is unique. We have helped over 7,000 homeowners, here is one of their stories.

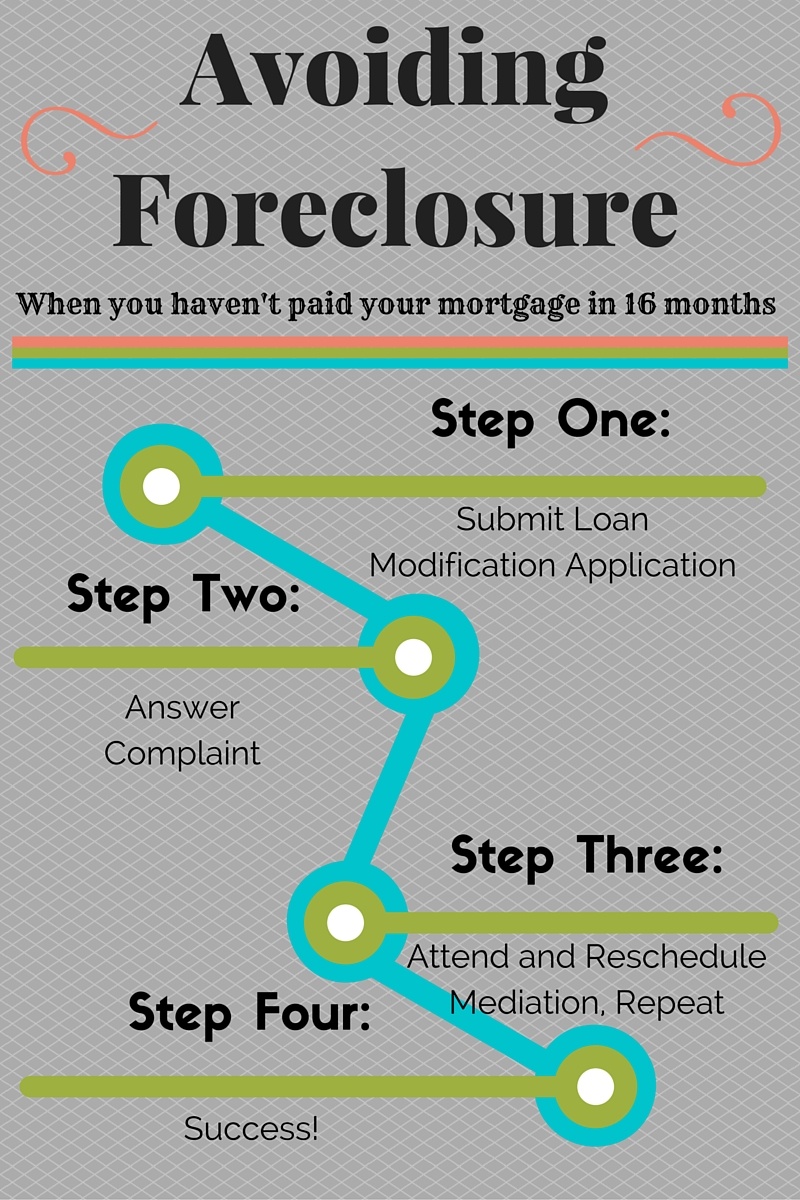

In January of 2016 we were hired by a Florida homeowner to help him avoid becoming a former homeowner. Let's call him Mr. Cohen to protect his privacy. Mr. Cohen definitely needed the help of an experienced foreclosure defense attorney. After falling behind on his mortgage his home was scheduled to be sold at a foreclosure auction on April 13th, so we immediately got to work to stop the sale and find a permanent solution.

We rushed to submit a Request for Modification Assistance (RMA) to Rushmore Servicing, Mr. Cohen's loan servicer, that would permanently modify his mortgage loan and return it to normal servicing if accepted.

As the April sale date approached the RMA had not been reviewed by the bank, so we filed a motion with the court to cancel the foreclosure sale. The motion was granted and the April sale date was canceled and rescheduled for June 14.

[fa icon="clock-o"] Thursday, July 14, 2016 [fa icon="user"] Maxwell Swinney [fa icon="folder-open'] loan modification, successful loan modifications, foreclosure defense

Read More »

Disclaimer: These results should not be taken as a guarantee, as each case is unique. We have helped over 7,000 homeowners.

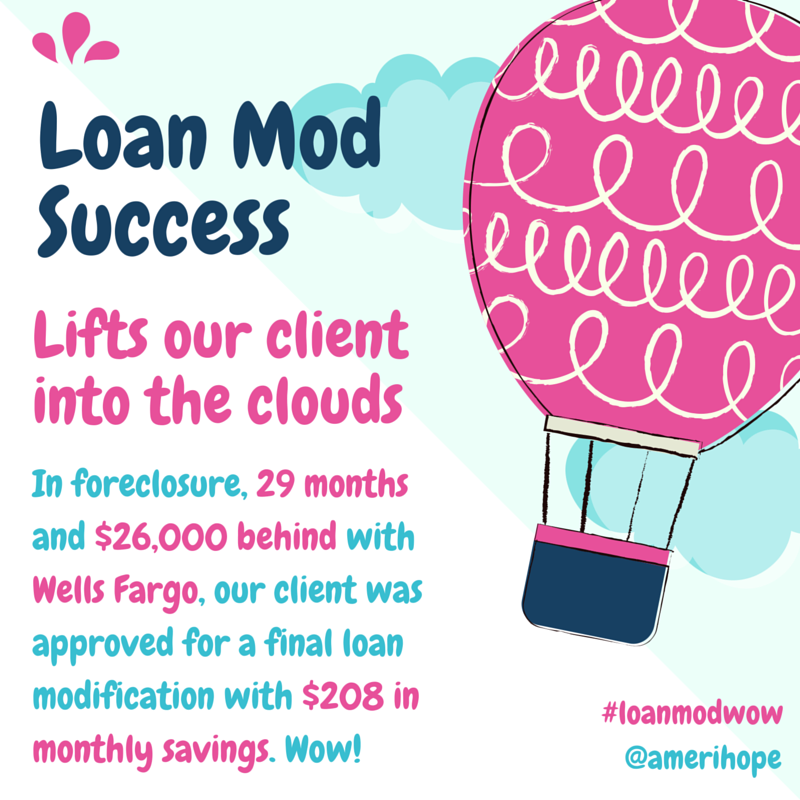

Every week we obtain loan modifications for our clients with a variety of loan servicers. You can see these results as they are announced on Twitter or Facebook. Here are some of the results from this week, which includes results from Wells Fargo and others:

[fa icon="clock-o"] Friday, July 8, 2016 [fa icon="user"] Maxwell Swinney [fa icon="folder-open'] wells fargo loan modification, loan modification, successful loan modifications

Read More »

Disclaimer: These results should not be taken as a guarantee, as each case is unique. We have helped over 7,000 homeowners.

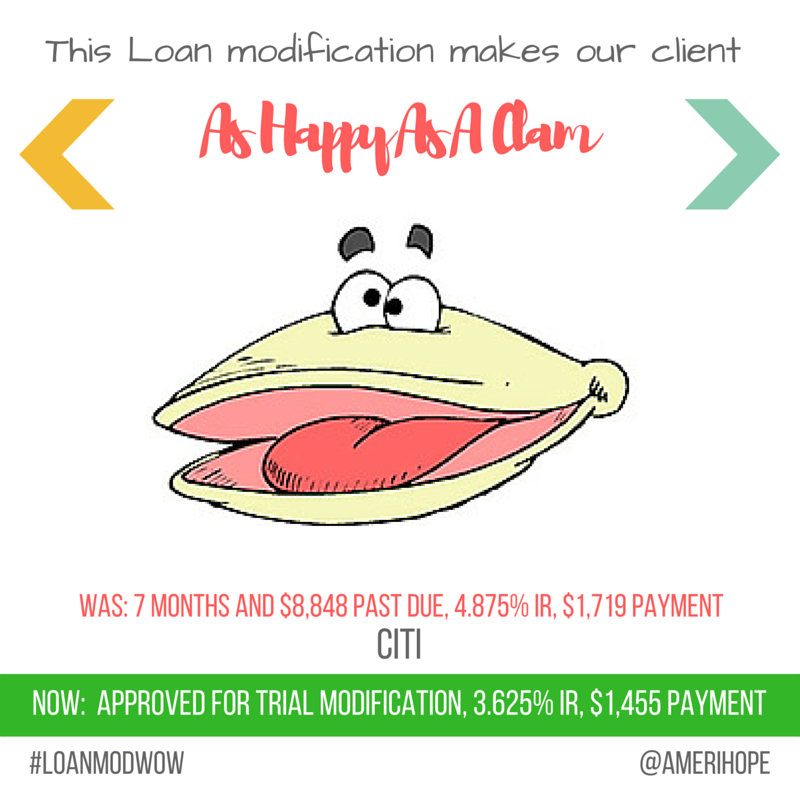

Every week we obtain loan modifications for our clients with a variety of loan servicers. You can see these results as they are announced on Twitter or Facebook. Here are some of the results from this week including results from Citi, Wells Fargo, HSBC, Greentree, Ocwen, SPS and others:

[fa icon="clock-o"] Friday, July 1, 2016 [fa icon="user"] Maxwell Swinney [fa icon="folder-open'] successful loan modifications

Read More »

Disclaimer: These results should not be taken as a guarantee, as each case is unique. We have helped over 7,000 homeowners.

Every week we obtain loan modifications for our clients with a variety of loan servicers. You can see these results as they are announced on Twitter or Facebook. Here are some of the results from this week including Ocwen, Wells Fargo and others:

[fa icon="clock-o"] Friday, June 24, 2016 [fa icon="user"] Maxwell Swinney [fa icon="folder-open'] bank of america loan modification, successful loan modifications, ocwen loan modification

Read More »

Disclaimer: These results should not be taken as a guarantee, as each case is unique. We have helped over 7,000 homeowners, here are some results that came in this week.

Every week we obtain loan modifications for our clients, we're working on a round up of results that came in which you can follow on Twitter or Facebook.

Keep reading to see: three (3) Ocwen modifications, two (2) Bayview loan modifications, three (3) Seterus modifications, one (1) Bank of America loan modification and one (1) Selene Finance mod.

[fa icon="clock-o"] Friday, June 17, 2016 [fa icon="user"] Maxwell Swinney [fa icon="folder-open'] bank of america loan modification, successful loan modifications, ocwen loan modification

Read More »

Disclaimer: These results should not be taken as a guarantee, as each case is unique. We have helped over 7,000 homeowners, here is one of their stories.

In 2008 an Illinois couple, who we'll call the Petersons to protect their privacy, purchased a home in the Chicago suburbs with a $216,464 loan from Citi Financial. By March of 2015 they had stopped making the $1,077 monthly mortgage payment because they could no longer afford it. By September of 2015 they were justifiably concerned that they would lose their home to foreclosure and hired Amerihope Alliance Legal Services to help.

Since the Petersons wanted to keep their home, getting a loan modification was the only hope they had to accomplish their goal. When approved, a loan mod will reinstate a loan and return it to normal servicing. Modified mortgage loans usually have a lower monthly payment and sometimes reduced principal as well.

We submitted the Peterson's modification application to their lender but weeks later, and while the application was under review, they were served a complaint letting them know they were in foreclosure.

We responded to the complaint for our client, letting CitiFinancial know we intended to fight for our client to avoid foreclosure and keep their home.

[fa icon="clock-o"] Thursday, June 16, 2016 [fa icon="user"] Maxwell Swinney [fa icon="folder-open'] loan modification, successful loan modifications, foreclosure

Read More »

Disclaimer: These results should not be taken as a guarantee, as each case is unique. We have helped over 5,000 homeowners, here is one of their stories.

In March 2015, we were retained to represent a Florida homeowner who was being sued by Dyck-O'neal to collect a post-foreclosure deficiency in the amount of $34,078.93 plus interest, costs, and attorney's fees. We won his case, and he owed nothing.

[fa icon="clock-o"] Tuesday, June 16, 2015 [fa icon="user"] Jake Sterling [fa icon="folder-open'] successful loan modifications, florida foreclosure attorney, foreclosure deficiency

Read More »Amerihope Alliance Legal Services is a leading loan modification and foreclosure defense law firm with attorneys licensed in 5 states. We have helped over 7,000 homeowners fight back and keep their homes.

Our goal is to provide valuable information to help homeowners who are trying to obtain a loan modification or to stop foreclosure. You may schedule a free consultation at any time.

Privacy Policy | Terms of Service | Site Map | Glossary | Contact Us

We are a debt relief agency. We help people file for bankruptcy relief under the Bankruptcy Code.

The hiring of a lawyer is an important decision that should not be based solely upon advertisements. This web site is designed for general information only. The facts and law in each case are different. We cannot and do not represent or guarantee a specific result in any given case. See our About Us page for our qualifications and experience.