Disclaimer: These results should not be taken as a guarantee, as each case is unique. We have helped over 7,000 homeowners. Here are a few of their stories.

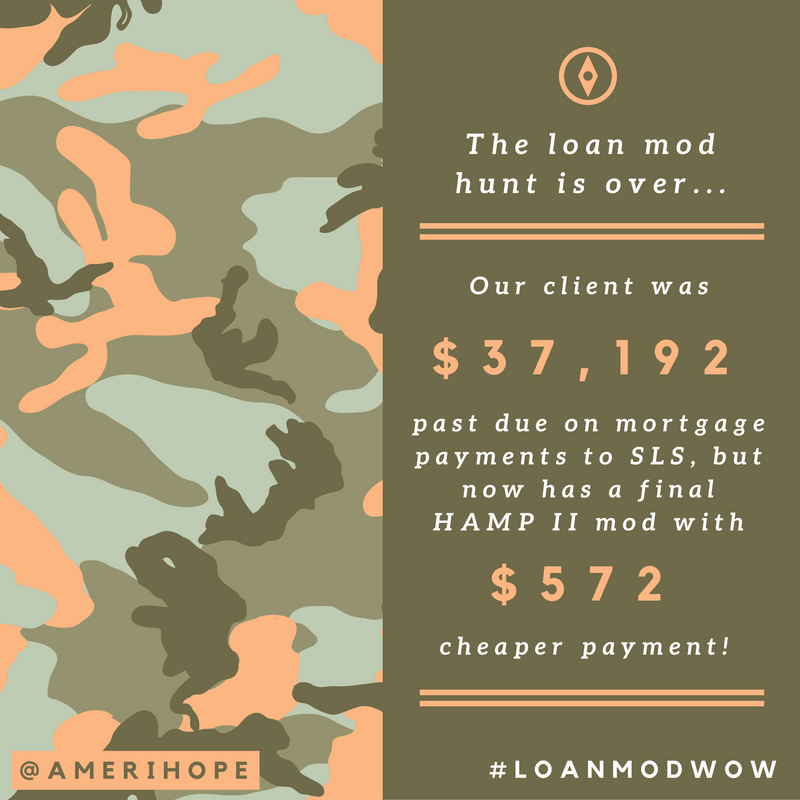

Every week we obtain loan modifications for our clients with a variety of loan servicers. You can see these results as they are announced on Twitter (#loanmodwow) or Facebook. Here are some of our results from this week with Seterus, Ocwen, Stearns Loan Care, Wells Fargo, SLS, and Bayview:

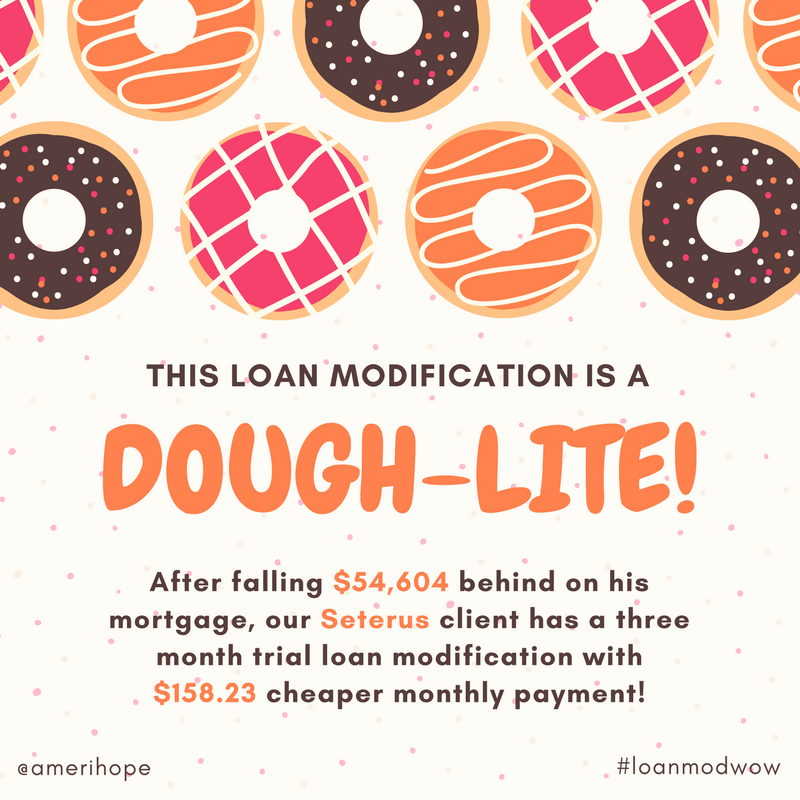

Seterus

After falling $54,604 behind on his mortgage, our Seterus client has a three month trial loan modification with $158.23 cheaper monthly payment!

Every week we obtain loan modifications for our clients with a variety of loan servicers. You can see these results as they are announced on

Every week we obtain loan modifications for our clients with a variety of loan servicers. You can see these results as they are announced on  Every week we obtain loan modifications for our clients with a variety of loan servicers. You can see these results as they are announced on

Every week we obtain loan modifications for our clients with a variety of loan servicers. You can see these results as they are announced on