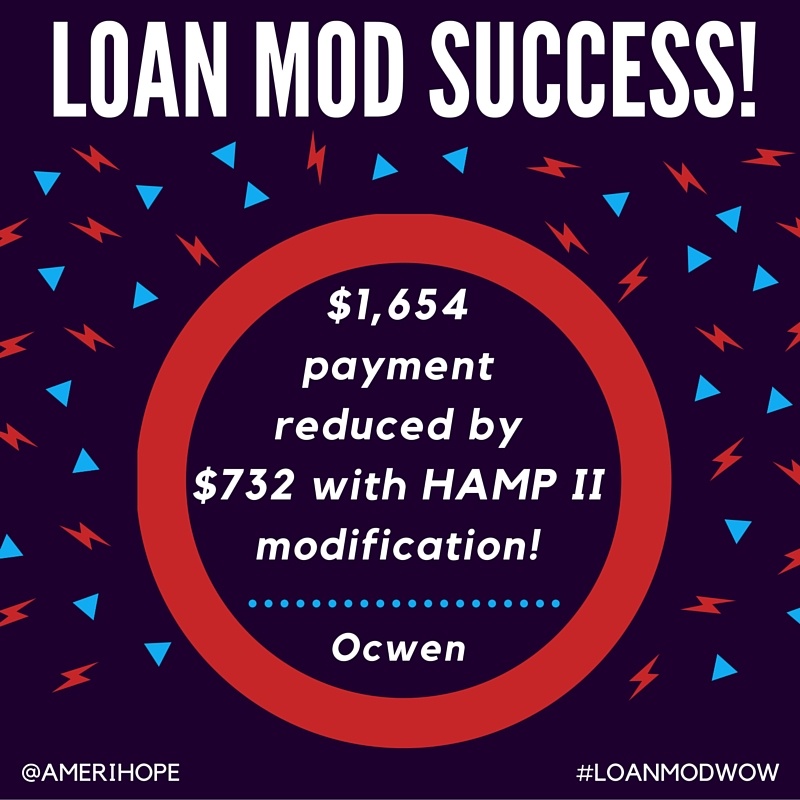

Disclaimer: These results should not be taken as a guarantee, as each case is unique. We have helped over 7,000 homeowners, here are a few of their stories.

Nationstar

- 8 years behind on mortgage payments to Nationstar, our client was approved for a loan modification with lower payment and interest rate, $88k principal forgiven, and $265k deferred!

- This in-house loan modification got our Nationstar client a fresh start with a cheaper payment and 2% lower interest rate!

Every week we obtain loan modifications for our clients with a variety of loan servicers. You can see these results as they are announced on

Every week we obtain loan modifications for our clients with a variety of loan servicers. You can see these results as they are announced on