The name Ocwen financial corporation may sound familiar considering they are one of the main providers of national residential and commercial mortgage loan servicing. They have headquarters in Georgia with offices in West Palm Beach and Orlando, Florida, amongst other locations throughout the United States. Ocwen is also licensed to service mortgage loans in all 50 states and has been servicing for over 25 years. To top it all off, Ocwen is the fourth ranked subprime mortgage servicing company behind the likes of giant familiar companies such as Bank of America/Countrywide and Chase Home Finance.

You might be saying to yourselves, “well, referring to the above information and the fact that Ocwen is such an immense servicing corporation, then why the 99 problems title?” It is not just meant to be a little clever... Listen closely and I'll explain why:

According to watchdog report titled “More Problems for Ocwen Customers” by WZZM 13 ABC news, correspondent Lee Van Ameyde reports that several homeowners in the Grand Rapids, Michigan area have been reporting issues with their new mortgage service corporation. Can you guess what company Ameyde is referring to? You got it, it's Ocwen.

Here's a short recap of Ocwen's shaky past year. Last year Ocwen had to settle with 48 states and give back about 2 billion dollars to Ocwen customers that had been harmed by unorthodox practices of Ocwen corp. The alleged practices included, unauthorized foreclosures, violating homeowners rights and using false and deceptive documents to confuse customers and make them pay unreasonably large amounts of money. Now, you'd think that Ocwen has learned to engage in ethical business practices after that 2 billion dollar settlement but, like the saying goes, old habits die hard. Once again, Ocwen is substantially raising homeowners' monthly payments with no legitimate reason why. How unsettling is that, I mean really, who doesn't want to know where their hard earned money goes?

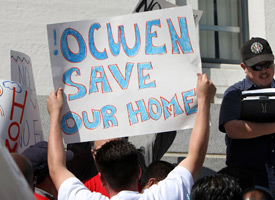

A few local Grand Rapids homeowners got together with Ameyde and gave insight on their experiences with Ocwen. Oh and let me tell you, they are not the least bit happy. Here are some concerns the homeowners discussed with Ameyde;

First, Ameyde asked the homeowners whether Ocwen had told them why their mortgage payment went up and out of 8 people, only 1 raised their hand. That is, 7 out of 8 people's mortgages were raised without explanation. For instance, homeowner Kathy's payment went from $931 in July to $4,061 in August. The payment went up a whopping 3 thousand dollars in a matter of a month. No wonder these homeowners can't afford their homes. Ocwen is now threatening Kathy with foreclosure.

Next, Ameyde asked whether the homeowners present were charged late fees even if the payments were not submitted late and 5 out of 8 people raised their hands. Meaning, Ocwen deliberately penalized homeowners without any wrongdoing on the homeowners part. Gee, just when you thought paying a good check on time was the right thing to do. Well, apparently for Ocwen, its just as bad as if you hadn't.

Ocwen's method of mishandling information and acting unfairly to homeowners whose mortgage is serviced by them has created frustration and several customers say that working with Ocwen is a traumatic experience. Homeowners go as far claiming that Ocwen has ruined their life and their credit.

Furthermore, these wronged homeowners can neither have their questions nor concerns properly addressed because Ocwen representatives can barely ever be reached. If and when a client is lucky enough to get ahold of someone by phone, their calls are transferred to places like India where the representatives are difficult to understand and are always inconsistent with their answers, leaving the homeowners with all of their doubt and no resolution. Statistics show that Ocwen has about 6,329 employees worldwide, including 4594 in their India operations centers, hundreds in the Philippines and several in Uruguay. Basically, that is where your calls are outsourced in order for Ocwen to beat around the bush and give you incomplete and false answers.

So what is a homeowner to do when their mortgage servicing company (Ocwen) is giving them the short end of the stick. Where the company often likes to substantially raise monthly payments and make- up late fees with no legitimate reason as to why exactly, all of which can cause someone to lose their home? Amayde says that if one is to experience similar problems with Ocwen or any other mortgage servicing company, then do not hesitate to contact the State Attorney's office and explain what is happening, that way, they can start to make things right for homeowners who are oppressed by the unfair acts of their respective mortgage servicing companies.

If you're interested in watching the video for yourself, click the link! http://stopforeclosurefraud.com/2014/05/07/watchdog-report-more-problems-for-ocwen-customers/