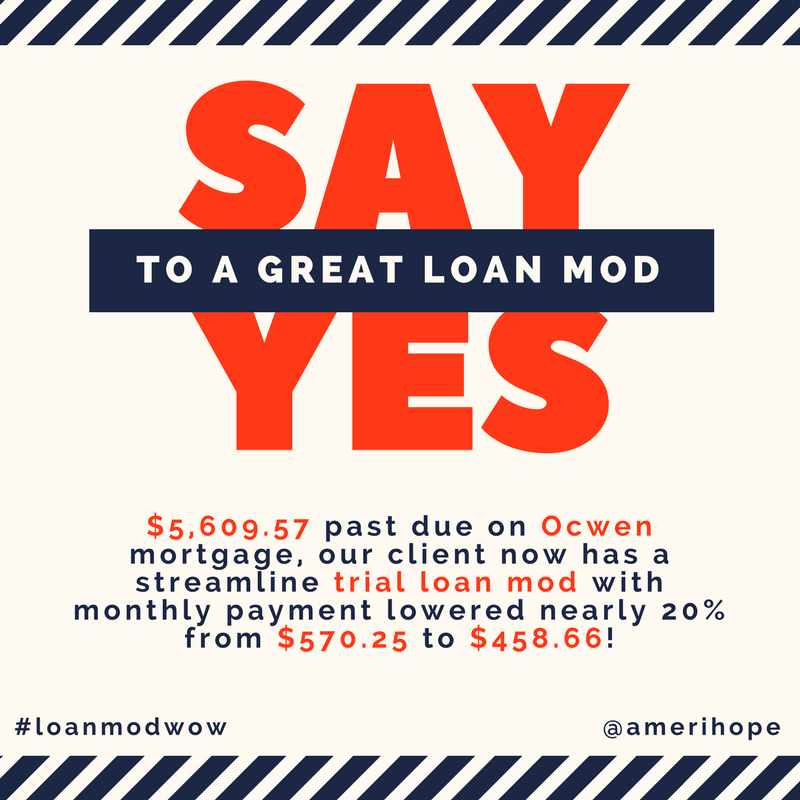

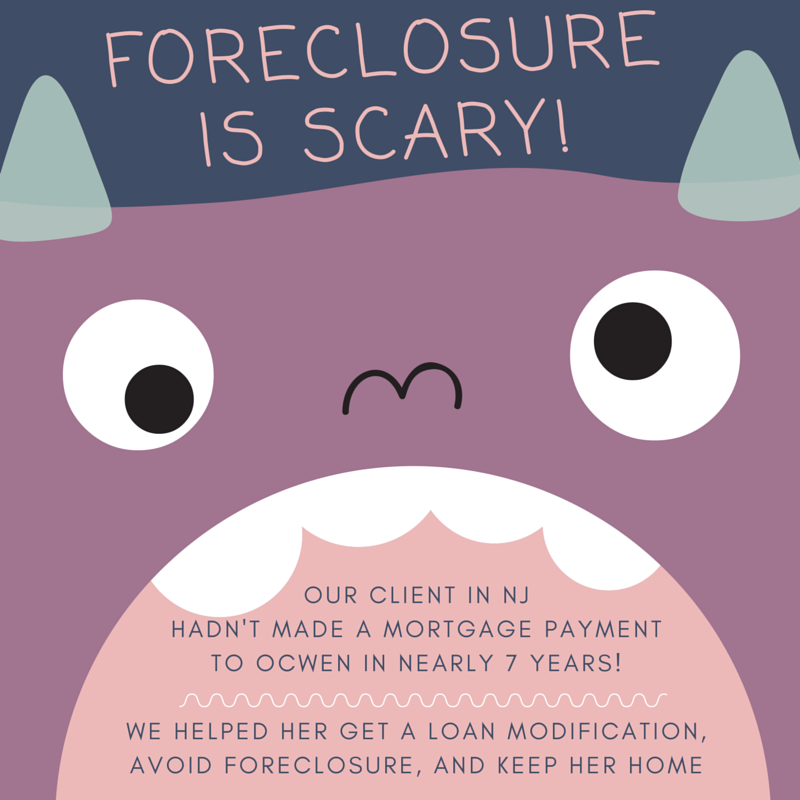

You had one job, Ocwen, and you couldn't even do that!

Mortgage servicer Ocwen is being sued by the Consumer Financial Protection Bureau (CFPB) for “failing borrowers at every stage of the mortgage servicing process.”

The lawsuit alleges that Ocwen's “widespread errors, shortcuts, and runarounds cost some borrowers money and others their home.”

According to the CFPB, for years Ocwen has consistently demonstrated an inability to perform the most fundamental duties required of a mortgage servicer, such as sending accurate monthly statements to borrowers, crediting their account for payment, and correctly handling tax and insurance payments.