The Hardest Hit Fund (HHF) was created by the federal government in 2010 to give financial aid to struggling homeowners in states that were most negatively impacted by the housing crisis and recession through loan modifications, mortgage payment assistance, and transition assistance programs. States were selected to receive funds from the program based on having above average rates of unemployment and decline in housing prices.

[fa icon="clock-o"] Friday, December 4, 2015 [fa icon="user"] Maxwell Swinney [fa icon="folder-open'] loan modification, hardest hit

Read More »

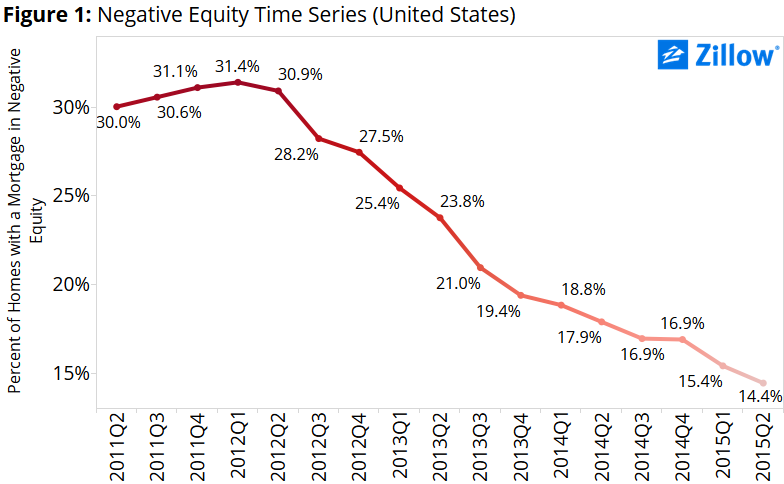

The percentage of Americans with negative equity in their homes, also known as being underwater, continued to fall in the second quarter of 2015 to 14.4%, according to a report from the real estate company Zillow. The rate of homeowners with negative equity has been dropping since the first quarter of 2012 when a high of 31.4% of homeowners were underwater.

[fa icon="clock-o"] Wednesday, December 2, 2015 [fa icon="user"] Maxwell Swinney [fa icon="folder-open'] loan modification, housing market, negative equity

Read More »

Beginning in 2014, the Consumer Financial Protection Bureau (CFPB) established new rules to protect homeowners facing foreclosure from unnecessary expenses and surprises. Among the rules are restrictions on the mortgage servicer's ability to pursue foreclosure while reviewing your application for a loan modification, a practice known as dual-tracking.

[fa icon="clock-o"] Monday, November 16, 2015 [fa icon="user"] Maxwell Swinney [fa icon="folder-open'] loan modification, loan modification help, dual-tracking, foreclosure

Read More »

The Home Affordable Modification Program is designed to reduce a homeowner's monthly payment to 31 percent of the homeowner's monthly gross income. In many cases, this could mean a reduction in principal or a lowered interest rate.

[fa icon="clock-o"] Wednesday, November 4, 2015 [fa icon="user"] Jake Sterling [fa icon="folder-open'] loan modification, home affordable mofication program qualifications, HAMP, hamp loan modification

Read More »

So, you're ready to apply for a mortgage loan modification. You've done a lot of research and think you should qualify, that there's no reason to believe you'll be denied. But before you get too excited about life with a modified loan and the reduced financial burden you'll have as a result, remember that a lien you don't even know you have will prevent you from getting that loan modification.

[fa icon="clock-o"] Friday, October 23, 2015 [fa icon="user"] Maxwell Swinney [fa icon="folder-open'] loan modification, foreclosure defense

Read More »

Rejection hurts. If you're like many people whose application for a mortgage loan modification has been denied, you don't know what to do. Should you rip the copper pipes out of your house, leave town and start a new life in Mexico, singing songs for loose change in sleepy tequila joints? Before you make that decision, remember that you can reapply for a loan modification.

[fa icon="clock-o"] Friday, September 25, 2015 [fa icon="user"] Maxwell Swinney [fa icon="folder-open'] loan modification, mortgage modification

Read More »

Believe it, or not, your mortgage lender is interested in the hardships you've endured that have led you to seek better terms on your mortgage loan. In fact, if you are facing foreclosure and looking for a loan modification, a letter explaining the hardships you've experienced is required.

[fa icon="clock-o"] Monday, September 21, 2015 [fa icon="user"] Maxwell Swinney [fa icon="folder-open'] loan modification, write a hardship letter, hardship letter

Read More »

Things always change, they never stay the same, that's life. Sometimes we are prepared for them and sometimes they are unexpected. What happens when the unexpected is a hardship like illness or suddenly finding yourself without gainful employment. A variety of circumstances can crop up that make it difficult for you to keep up with your mortgage payments. While foreclosures and short sales are options, the premier option for struggling homeowners who want to keep their home are loan modifications. Loan modifications are a change in one or more of the terms of the original loan.

[fa icon="clock-o"] Friday, June 5, 2015 [fa icon="user"] Jake Sterling [fa icon="folder-open'] loan modification

Read More »

1. Natural Disasters.

Floods, earthquakes, hurricanes, tornadoes, etc. During natural disaster, people will skedaddle from their homes and sometimes they never return.

2. War or Civil Conflict.

Violence, anarchy, etc. In times of war and civil conflict there are lots of people who will just abandon their homes and never ever come back.

[fa icon="clock-o"] Monday, January 19, 2015 [fa icon="user"] Jake Sterling [fa icon="folder-open'] loan modification attorney, loan modification, loan modification help, Abandoned Homes

Read More »

When it comes to applying for a loan modification, your debt-to-income ratio is really very important. Having the right or wrong DTI ratio can make or break your loan modification. But what is debt to income ratio? Let's dive right in. President Obama's foreclosure prevention plan has it set up so that for your first mortgage, your Front-end debt-to-income ratio can be no more than 31 percent. This basically means that your house payment cannot exceed 31 percent of your gross monthly income. So if for example your monthly mortgage is $1,000, your gross monthly income should be at around $3,230 or more.

There are actually 2 debt-to-income (DTI) ratios to become familiar with:

- First there's your Front-end DTI ratio which is based on your house payment. Under the President's plan, the Front-end DTI ratio target of 31 percent only applies to your first mortgage. Other loans taken against your home such as a second mortgage or an equity line of credit are separate and are not a part of your Front-end DTI. Instead, you can calculate these other loans as a part of your Back-end DTI. But wait, what is Back-end DTI? I'm glad you asked!

- Besides Front-end DTI, you also have your Back-end DTI ratio which is based on all your monthly debt payments combined. This includes your house payment, credit card payments, auto loan payments.

[fa icon="clock-o"] Wednesday, January 7, 2015 [fa icon="user"] Jake Sterling [fa icon="folder-open'] loan modification, loan modification help

Read More »