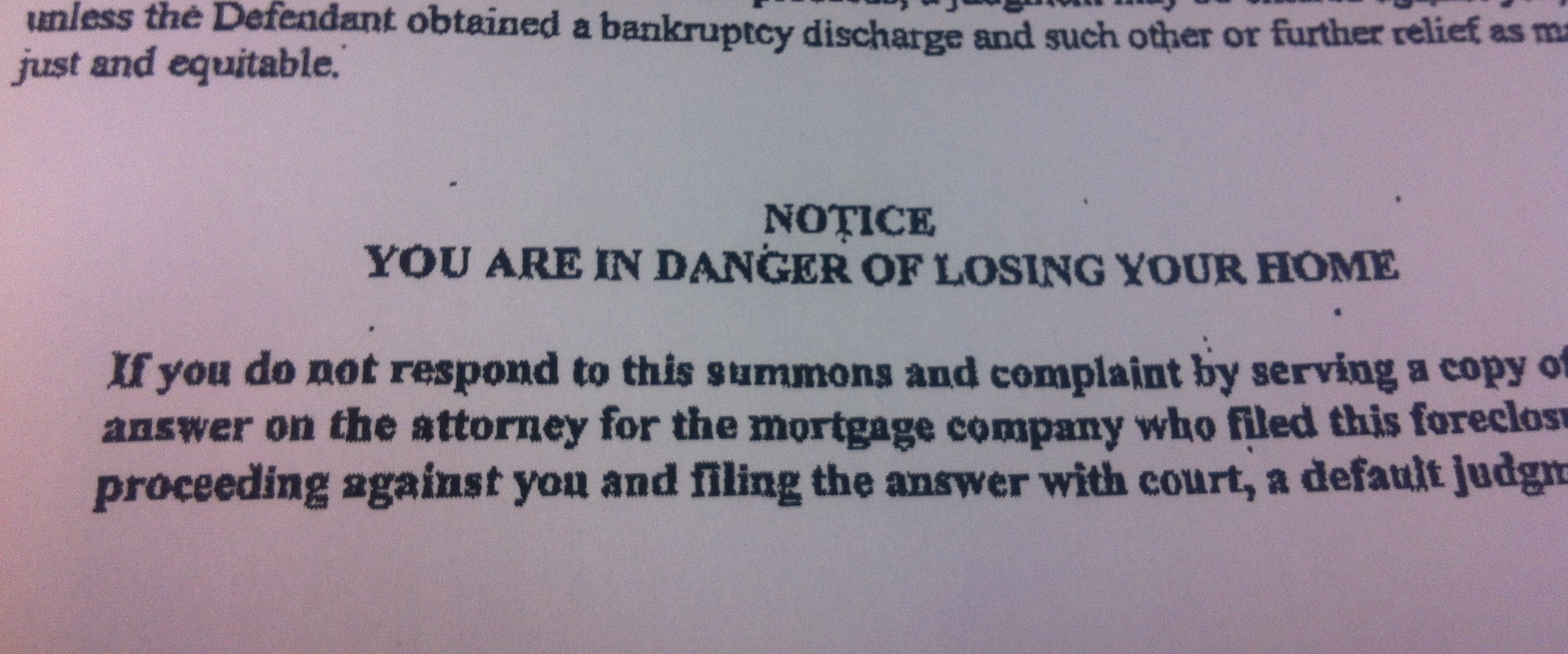

Falling behind on your mortgage doesn't mean losing your home to foreclosure is a foregone conclusion. What happens and when depends in large part on how you respond to your situation. You may be able to keep your home or at least exit it under the best circumstances. But to do that you have to act on good information and avoid the mistakes that are often made by homeowners in foreclosure, which include:

1. Assuming your lender is going to help you.

Though your lender has the power to help you, you should not assume that they will. You and your lender's goals don't always align. Following a default, you probably want to keep your home but with a lower payment. The bank simply wants to make as much money as possible from the loans in their portfolio. Sometimes helping you keep your home is also the best way for the bank to make the most money, sometimes not.