Disclaimer: These results should not be taken as a guarantee, as each case is unique. We have helped over 7,000 homeowners. Here are a few of their stories.

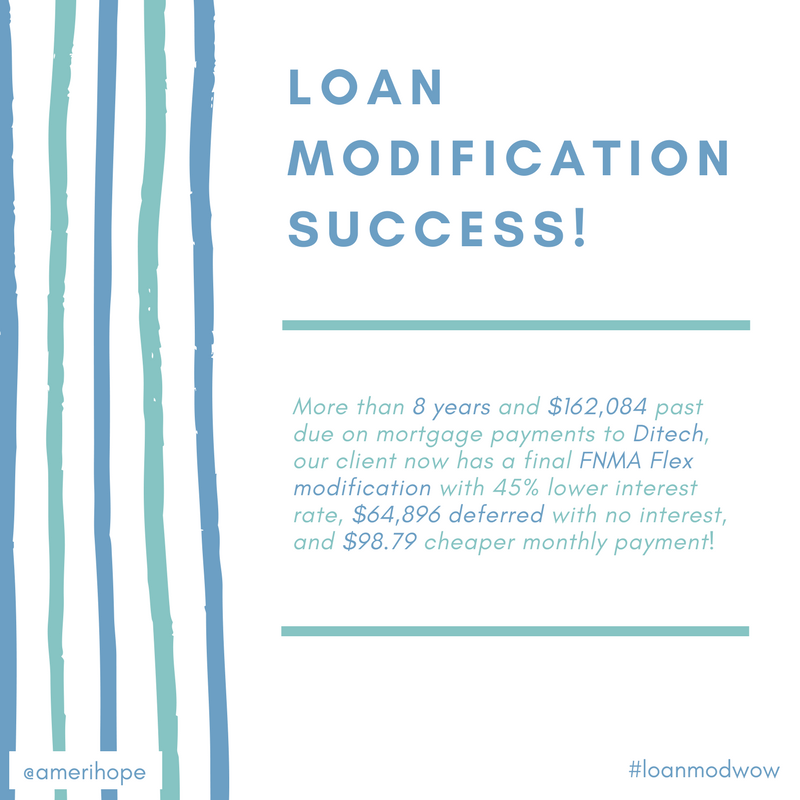

Every week we obtain loan modifications for our clients with a variety of loan servicers. You can see these results as they are announced on Twitter (#loanmodwow) or Facebook. Here are some of our results from this week with Seterus, Ditech, Carrington, Caliber, Trumark Financial, Ocwen, and Loan Care:

Carrington

Great success! Our Carrington Mortgage client has a three month FHA HAMP trial loan modification with $276.81 cheaper monthly payment after falling six months behind on his mortgage payments.