Disclaimer: These results should not be taken as a guarantee, as each case is unique. We have helped over 7,000 homeowners. Here are a few of their stories.

Disclaimer: These results should not be taken as a guarantee, as each case is unique. We have helped over 7,000 homeowners. Here are a few of their stories.

Every week we obtain loan modifications for our clients with a variety of loan servicers. You can see these results as they are announced on Twitter (#loanmodwow) or Facebook. Here are some of our results from this week with Ditech and Selene:

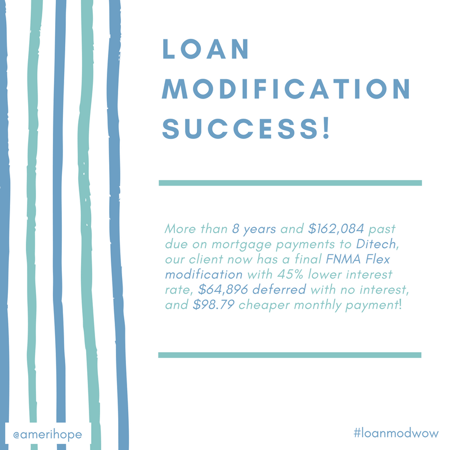

Ditech

More than 8 years and $162,084 past due on mortgage payments to Ditech, our client now has a final FNMA Flex modification with 45% lower interest rate, $64,896 deferred with no interest, and $98.79 cheaper monthly payment!

Selene

Our Selene client was $57,996.14 past due on mortgage, but now has a HAMP trial loan modification with low interest rate.