Disclaimer: These results should not be taken as a guarantee, as each case is unique. We have helped over 7,000 homeowners. Here are some of their stories.

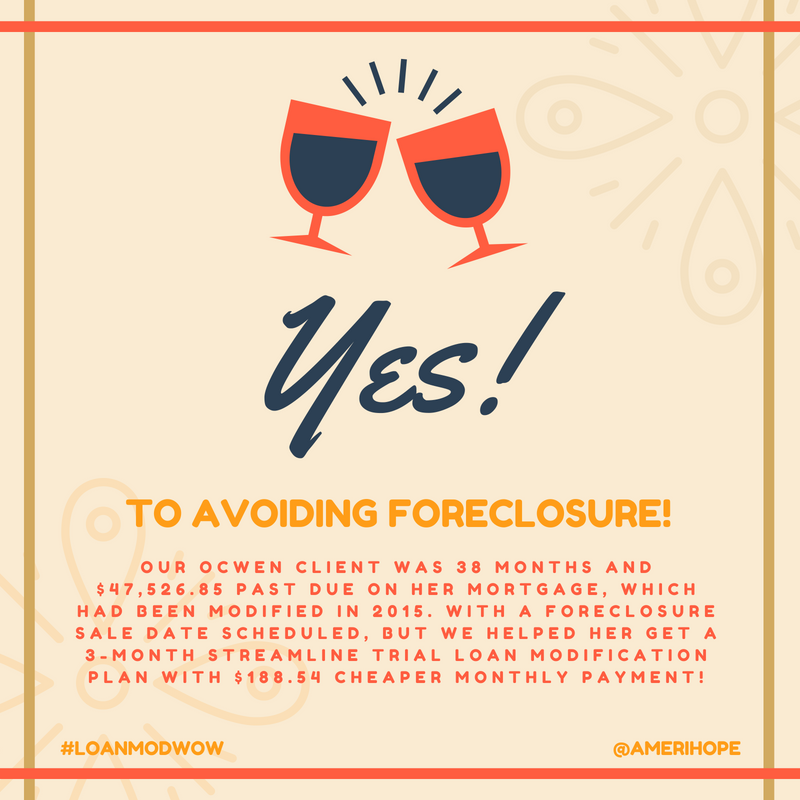

Every week we obtain loan modifications for our clients with a variety of loan servicers. You can see these results as they are announced on Twitter (#loanmodwow) or Facebook. Here are some of our results from this week with Bank of America, Ocwen, Caliber, Lakeview Loan Servicing, and M&T Bank:

Bank of America

Our Bank of America client was 14 months and $21,765+ fees past due on his mortgage with foreclosure started, but we helped him get a three month FHA-HAMP trial loan modification plan with $179.59 cheaper monthly payment!