If you miss mortgage payments, or pay less than what is required, then you're in default on your mortgage loan. Your lender will at some point send you a notice of default letter notifying you that by not paying your mortgage, you're in violation of the terms of the promissory note that you signed and are at risk of losing your home to foreclosure.

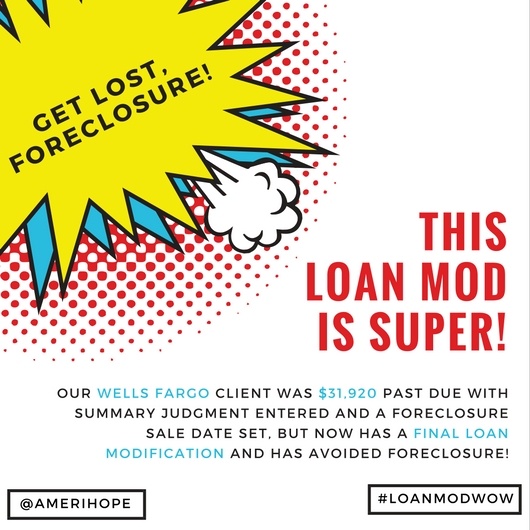

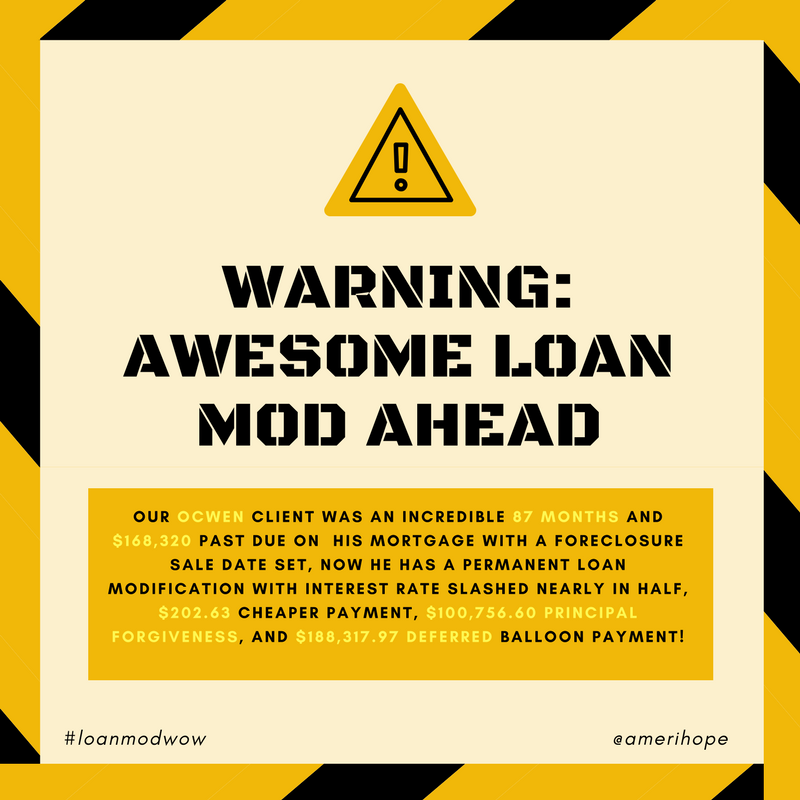

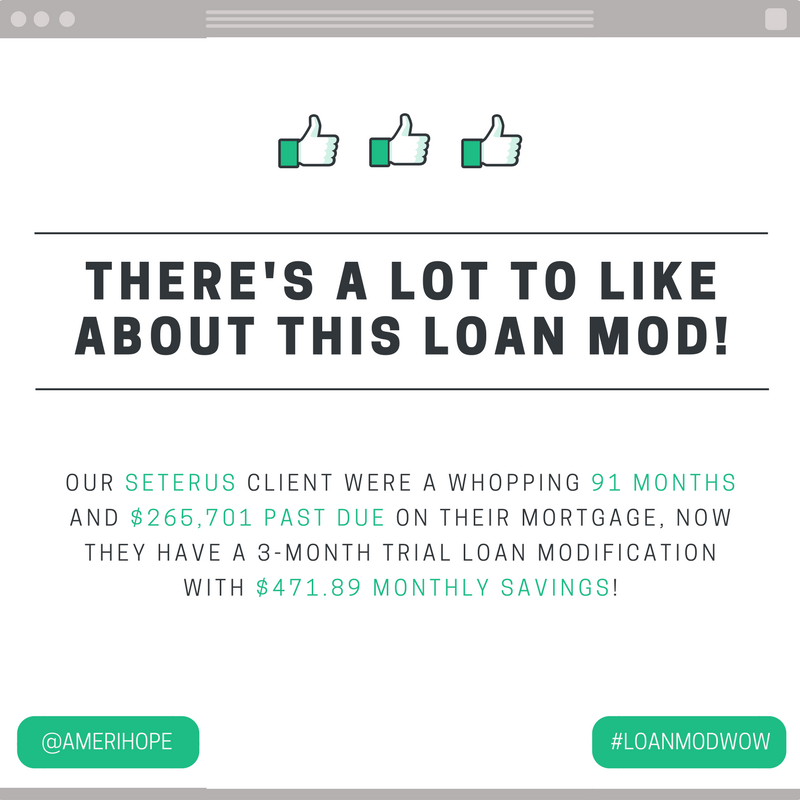

If you don't work things out by reinstating your loan (paying the entire amount you're behind), agreeing to a repayment plan, or getting a loan modification, then the foreclosure process will continue.

Further along in the foreclosure process there's another type of default that can happen called a judicial default or clerk's default. A judicial default is a “binding judgment in favor of either party based on some failure to take action by the other party.”