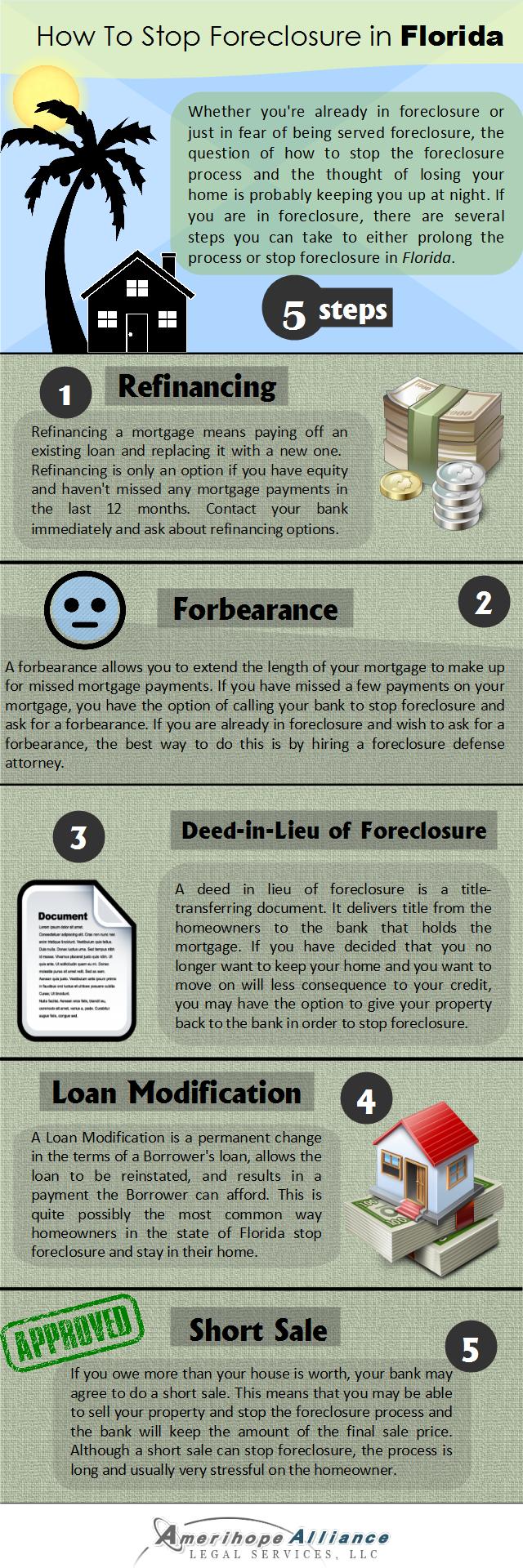

Florida has one of the highest rates of foreclosure in the country. The state has a foreclosure process that is judicial. The lender must file with the court to take possession of the property. If you're in foreclosure or in fear of foreclosure, there are several steps you can take to either prolong the process or stop foreclosure in Florida.

Jake Sterling

Recent Posts

[fa icon="clock-o"] Friday, September 6, 2013 [fa icon="user"] Jake Sterling [fa icon="folder-open'] florida foreclosure process, florida foreclosure attorney

Read More »Amerihope Alliance Legal Services and attorney Greg Nordt warn consumers:  Do not pay fees to debt relief companies that promise that they can negotiate a pay off and stop the payday loan companies from calling you. They can't. They charge a consumer for an attorney to send their payday loan company a cease and desist letter and a letter of negotiation. Neither of these letters with help you in any way more than you can help yourself. These type of scam companies are preying on payday loan consumer's fears.

Do not pay fees to debt relief companies that promise that they can negotiate a pay off and stop the payday loan companies from calling you. They can't. They charge a consumer for an attorney to send their payday loan company a cease and desist letter and a letter of negotiation. Neither of these letters with help you in any way more than you can help yourself. These type of scam companies are preying on payday loan consumer's fears.

[fa icon="clock-o"] Friday, September 6, 2013 [fa icon="user"] Jake Sterling [fa icon="folder-open'] Scam Alert

Read More »

Has HB 87 Solved Florida's Foreclosure Problems?

Florida experienced the most intense and widespread ravages of the mortgage crisis in 2008, and new foreclosures are still occuring at an alarming rate a half decade later. Even worse, Florida is a judicial foreclosure state. This means that all foreclosures have to proceed through a set process in the court of law, which can take years for each individual case. In addition to the new cases that are entering the courts daily, there are over 100,000 cases still waiting to be re-tried after the "robo-signing" scandal shut down all Florida foreclosure proceedings in late 2010. These factors combined to create a perfect storm of epic proportions in Florida's courts: so large, in fact, that there are currently over 328,000 foreclosures languishing within Florida's judicial system.

[fa icon="clock-o"] Friday, September 6, 2013 [fa icon="user"] Jake Sterling [fa icon="folder-open'] florida foreclosure defense, stop foreclosure in florida, florida foreclosure laws

Read More »

Been Through the Short Sale, Bankruptcy, or Foreclosure Process? FHA Will Help You Get a New Home Loan.

It's a lot easier for formerly troubled homeowners to get an Federal Housing Administration (FHA) loan. That's because FHA has formally announced that potential borrowers will qualify for an FHA-backed mortgage only a year after bankruptcy, foreclosure, or the short sale process was complete. In years past, potential homeowners would have to wait two years after bankruptcy and three years after foreclosure or short sale to qualify for a new FHA mortgage; that was simply just regarded as an extended part of the foreclosure process. This program is called "Back to Work", and will be getting to work for soon-to-be homeowners immediately.

[fa icon="clock-o"] Wednesday, September 4, 2013 [fa icon="user"] Jake Sterling [fa icon="folder-open'] understanding credit, short sale

Read More » Florida may be in the Southernmost part of the United States, but it was and still is the center of the foreclosure crisis. Even today, thousands of Floridians are served with foreclosure papers every month. Florida is a judicial foreclosure state, meaning that foreclosures have to proceed through through the court system in order to be completed. This combination of judicial foreclosure and the severity of the foreclosure crisis has created what is consistently the nation's largest backlog of foreclosure cases; a problem which Florida's government had not addressed until recently.

Florida may be in the Southernmost part of the United States, but it was and still is the center of the foreclosure crisis. Even today, thousands of Floridians are served with foreclosure papers every month. Florida is a judicial foreclosure state, meaning that foreclosures have to proceed through through the court system in order to be completed. This combination of judicial foreclosure and the severity of the foreclosure crisis has created what is consistently the nation's largest backlog of foreclosure cases; a problem which Florida's government had not addressed until recently.

[fa icon="clock-o"] Monday, September 2, 2013 [fa icon="user"] Jake Sterling [fa icon="folder-open'] florida foreclosure defense, foreclosure defense, florida foreclosure laws

Read More »

Disclaimer: These results should not be taken as a guarantee, as each case is unique. We have helped over 5,000 homeowners, here is one of their stories.

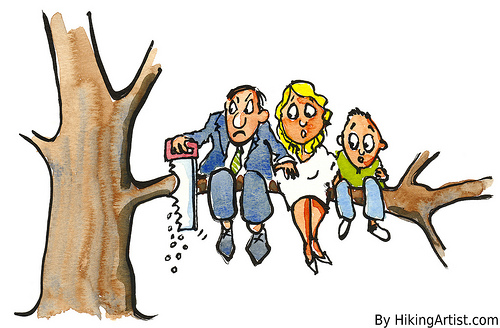

Aside from the infamous "subprime mortgages," one of the major contributors to the foreclosure crisis was banks giving out home loans at unfair terms. Many homeowners simply couldn't afford their homes once the economy slowed. One homeowner had experienced problems with getting on top of his loan for years; his entire situation changed when he spoke with us.

This homeowner hadn't paid on his mortgage since around the start of the mortgage crisis. In fact, he hadn't paid his mortgage for six years. In addition to being over $150,000 behind on paying his $2,000 monthly mortgage payment, our homeowner was paying an astronomically high 9.34% interest rate. Somehow, he had managed to stay out of foreclosure during that time, but he knew that wouldn't always be the case. That's when the homeowner retained (hired) us to help him modify his home loan in June 2013.

[fa icon="clock-o"] Saturday, August 31, 2013 [fa icon="user"] Jake Sterling [fa icon="folder-open'] bank of america loan modification, successful loan modifications

Read More »

[fa icon="clock-o"] Friday, August 30, 2013 [fa icon="user"] Jake Sterling [fa icon="folder-open'] loan modification, foreclosure defense, short sale

Read More »

By Ralph R. Roberts, RISMedia Guest Columnist

[fa icon="clock-o"] Wednesday, August 28, 2013 [fa icon="user"] Jake Sterling [fa icon="folder-open'] stop foreclosure, how to stop foreclosure

Read More »

Disclaimer: These results should not be taken as a guarantee, as each case is unique. We have helped over 5,000 homeowners, here is one of their stories.

What would you do if you were emerging from the shadows of bankruptcy, had already lost one of your cars to repossession, and your house was now in danger of being foreclosed? If you're like this couple, then you fight back.

Emerging From The Shadows

We met this married couple when they retained (hired) us in late 2011. They couldn't afford to pay their $2,600 mortgage payment and were several months behind.

[fa icon="clock-o"] Saturday, August 24, 2013 [fa icon="user"] Jake Sterling [fa icon="folder-open'] successful loan modifications, foreclosure defense

Read More »

[fa icon="clock-o"] Friday, August 23, 2013 [fa icon="user"] Jake Sterling [fa icon="folder-open'] pennsylvania foreclosure defense

Read More »