Happy Friday!

We are proud to announce that we have updated the design of our blog. You should find it to be much easier to navigate on mobile.

Happy Friday!

We are proud to announce that we have updated the design of our blog. You should find it to be much easier to navigate on mobile.

[fa icon="clock-o"] Friday, August 17, 2018 [fa icon="user"] Kristen Clinton

Read More »

If you are trying to obtain a loan modification or other loan workout plan, then your bank’s guidelines are going to require that you write a hardship letter.

[fa icon="clock-o"] Monday, July 23, 2018 [fa icon="user"] Kristen Clinton [fa icon="folder-open'] loan modification attorney, write a hardship letter, hardship letter

Read More »

Our attorney Gregory Nordt, Esq. was featured lastnight on Real Money with Ali Velshi. Parts of Florida still have extremely high foreclosure rates topping the charts with New Jersey and New York.

[fa icon="clock-o"] Thursday, February 20, 2014 [fa icon="user"] Kristen Clinton [fa icon="folder-open'] florida foreclosure defense

Read More »

Learn 8 ways that homeowners can (or cannot) stop foreclosure. Does refinancing stop foreclosure? Does loan modification?

If you are facing foreclosure, it's important to learn about your situation and be prepared.

Click through to see the slideshow.

[fa icon="clock-o"] Friday, December 6, 2013 [fa icon="user"] Kristen Clinton [fa icon="folder-open'] stop foreclosure, foreclosure defense

Read More »

Remember 2005? 2006? Remember the commercials on TV, and radio and everywhere telling you about the “cash rewards” and “cash out” refinances? So many Americans took advantage of these programs. Business was great, real estate was better.

Our client Dale, like thousands of other Americans, took advantage of one of these programs, and received cash out of his mortgage (and a 9.75% interest rate!) when he refinanced with Countrywide. In 2008, the Bank of America/Countrywide merger meant that Dale now had to deal with Bank of America.

[fa icon="clock-o"] Friday, November 8, 2013 [fa icon="user"] Kristen Clinton [fa icon="folder-open'] bank of america loan modification, loan modification, bank of america loan modification problems

Read More »

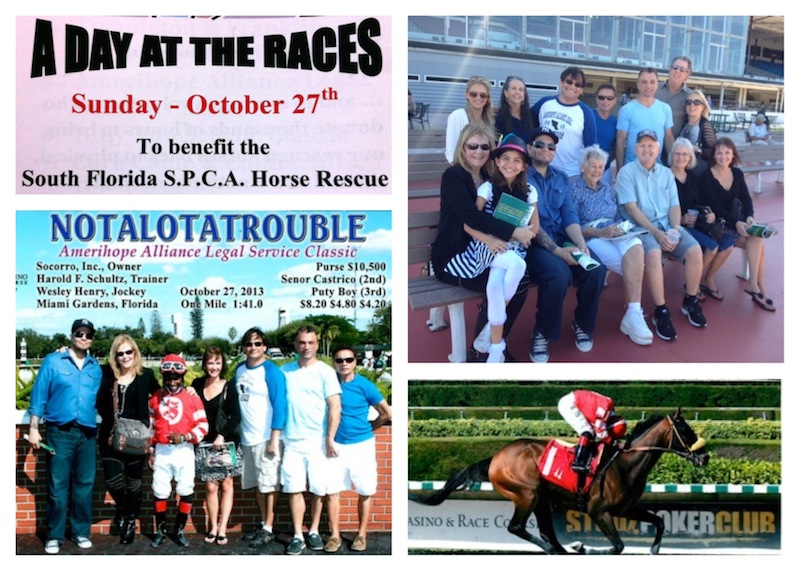

Sunday was a perfect day to spend at Calder Race Course. Breezy, sunny and a very comfortable 79 degrees. The best part was Amerihope Alliance Legal Services had the opportunity to sponsor a race for the SPCA horse rescue. Our law firm sponsored the 5th race and although none of us bet on the winning horse, Notalotatrouble, we all enjoyed the day and had lots of laughs.

[fa icon="clock-o"] Tuesday, October 29, 2013 [fa icon="user"] Kristen Clinton [fa icon="folder-open'] foreclosure defense

Read More »

[fa icon="clock-o"] Wednesday, July 24, 2013 [fa icon="user"] Kristen Clinton [fa icon="folder-open'] foreclosure defense, short sale

Read More »

Editor's note: This article was originally published June 2013, and has been updated in November 2015. Some reported facts are from 2012 and 2013, but HAMP information is current as of this date.

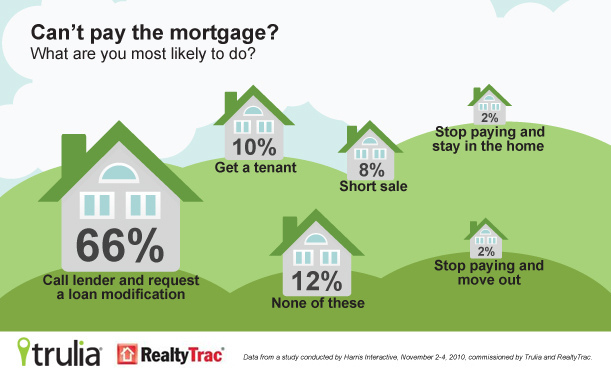

In May 2013, the credit reporting agency TransUnion reported that the percentage of mortgage holders with mortgages 60 days or more delinquent decreased 12% from the fourth quarter (Q4) of 2012 to 4.36% and a 21% drop from Q1 2013. Both numbers represent the biggest declines since TransUnion started tracking mortgage delinquency data.

Nonetheless, too many homeowners continue to have difficulties making their mortgage payments each month and suffer financial hardship. Due to a lack of accurate information, a large number of these borrowers do not realize that they may be eligible for financial relief under the federal government’s Making Home Affordable loan modification program.

Here are six of the most misunderstood aspects about the Making Home Affordable Program.

[fa icon="clock-o"] Monday, June 24, 2013 [fa icon="user"] Kristen Clinton [fa icon="folder-open'] loan modification, HAMP, hamp loan modification, loan modification help

Read More »

So you've missed a payment on your Illinois home. Any number of a various set of circumstances has conspired to affect your income and consequently your ability to keep up with your obligations. You held it together as long as you could, but now the unthinkable has happened and you are late on your mortgage. You may feel alone, embarrassed, and quite afraid of being foreclosed upon. Well cheer up homeowner because you are not alone and there is no need to be embarrassed or fear the foreclosure process in Illinois.

Illinois is a judicial foreclosure state, which means that the foreclosure process in Illinois requires certain steps to be taken by your lender before they can take possession of your home. In other words, this means you have some time to fix this. If you're into legalese, you can read the entire statute here, however if you're just looking for some unbiased information and perhaps a little help for your situation, continue reading.

[fa icon="clock-o"] Wednesday, May 29, 2013 [fa icon="user"] Kristen Clinton [fa icon="folder-open'] illinois foreclosure lawyer, foreclosure defense

Read More »

For home and condominium owners, the housing crisis brought a host of financial challenges, forcing many into or on the brink of foreclosure. Now, in addition to struggling with bank notices and loan modifications, the financial industry has added another compounding hardship for property owners: force-placed property insurance.

Force-placed property insurance has become something of a recent development arising out of the financial crisis. This is a mortgage or loan lender practice implemented mostly in states like Florida, New York, Pennsylvania, and New Jersey that were hit hardest by the housing crisis and were victims of recent natural disasters, like Hurricane Sandy. The property insurance required by the lender insures against natural disaster and human-inflicted damages.

[fa icon="clock-o"] Wednesday, April 17, 2013 [fa icon="user"] Kristen Clinton [fa icon="folder-open'] loan modification attorney, loan modification

Read More »Amerihope Alliance Legal Services is a leading loan modification and foreclosure defense law firm with attorneys licensed in 5 states. We have helped over 7,000 homeowners fight back and keep their homes.

Our goal is to provide valuable information to help homeowners who are trying to obtain a loan modification or to stop foreclosure. You may schedule a free consultation at any time.

Privacy Policy | Terms of Service | Site Map | Glossary | Contact Us

We are a debt relief agency. We help people file for bankruptcy relief under the Bankruptcy Code.

The hiring of a lawyer is an important decision that should not be based solely upon advertisements. This web site is designed for general information only. The facts and law in each case are different. We cannot and do not represent or guarantee a specific result in any given case. See our About Us page for our qualifications and experience.