Disclaimer: These results should not be taken as a guarantee, as each case is unique. We have helped over 7,000 homeowners, here is one of their stories.

In 2008 an Illinois couple, who we'll call the Petersons to protect their privacy, purchased a home in the Chicago suburbs with a $216,464 loan from Citi Financial. By March of 2015 they had stopped making the $1,077 monthly mortgage payment because they could no longer afford it. By September of 2015 they were justifiably concerned that they would lose their home to foreclosure and hired Amerihope Alliance Legal Services to help.

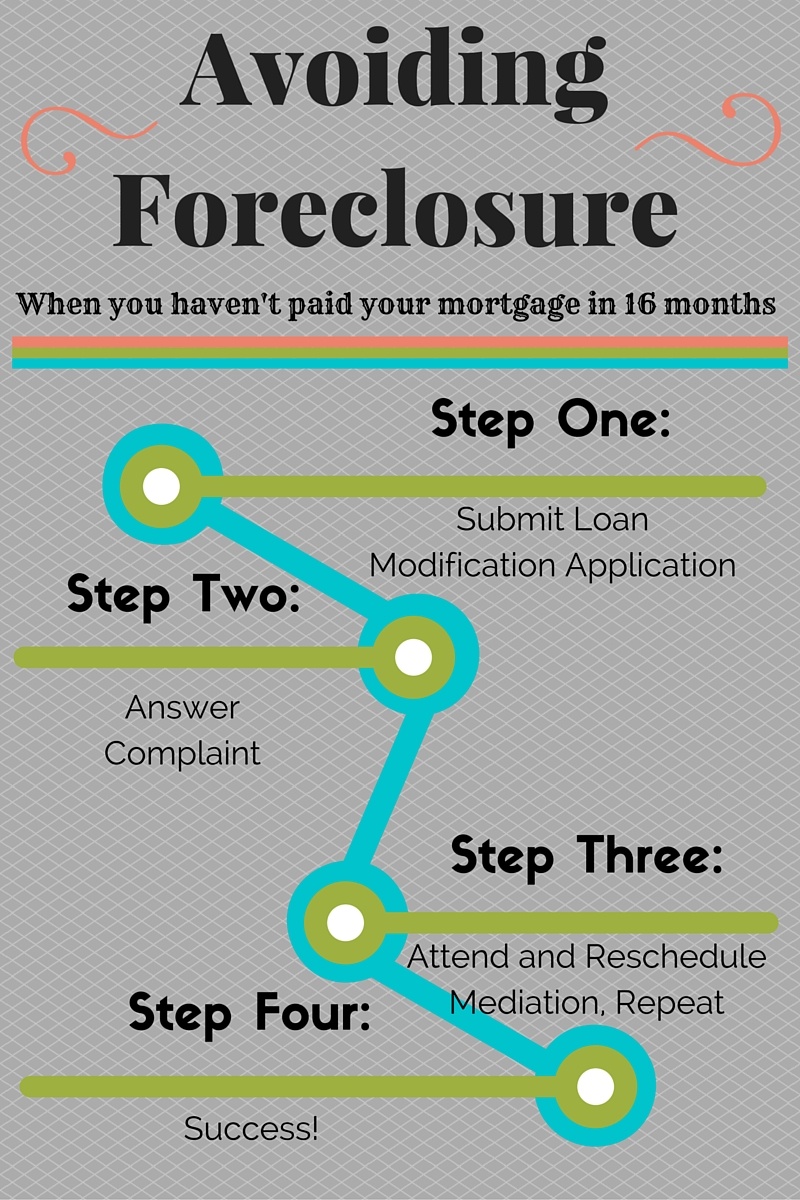

Step One: Submit Loan Modification Application

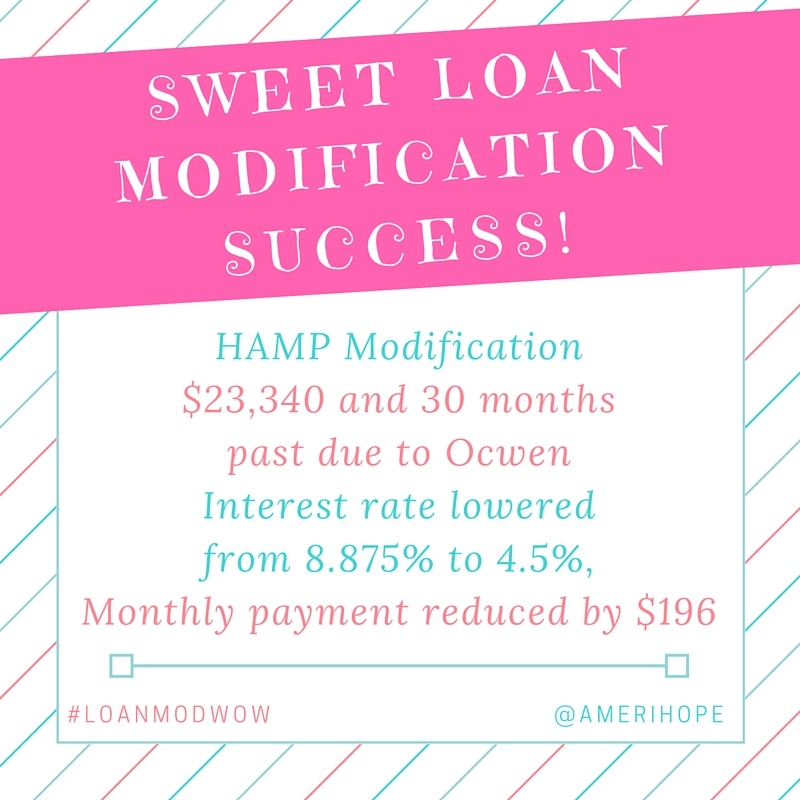

Since the Petersons wanted to keep their home, getting a loan modification was the only hope they had to accomplish their goal. When approved, a loan mod will reinstate a loan and return it to normal servicing. Modified mortgage loans usually have a lower monthly payment and sometimes reduced principal as well.

We submitted the Peterson's modification application to their lender but weeks later, and while the application was under review, they were served a complaint letting them know they were in foreclosure.

Step Two: Answer Foreclosure Complaint

We responded to the complaint for our client, letting CitiFinancial know we intended to fight for our client to avoid foreclosure and keep their home.