The name Ocwen financial corporation may sound familiar considering they are one of the main providers of national residential and commercial mortgage loan servicing. They have headquarters in Georgia with offices in West Palm Beach and Orlando, Florida, amongst other locations throughout the United States. Ocwen is also licensed to service mortgage loans in all 50 states and has been servicing for over 25 years. To top it all off, Ocwen is the fourth ranked subprime mortgage servicing company behind the likes of giant familiar companies such as Bank of America/Countrywide and Chase Home Finance.

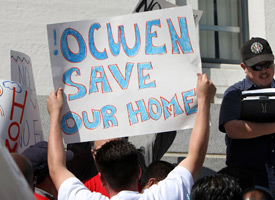

You might be saying to yourselves, “well, referring to the above information and the fact that Ocwen is such an immense servicing corporation, then why the 99 problems title?” It is not just meant to be a little clever... Listen closely and I'll explain why: