Disclaimer: These results should not be taken as a guarantee, as each case is unique. We have helped over 5,000 homeowners, here is one of their stories. A newly single Florida homeowner had endured a financial hardship for nearly half a decade, and by the time he was able to begin picking up the pieces, he was 5 years and over $156,000 behind on his mortgage payments to Ocwen Financial. This homeowner was locked into a monthly mortgage payment of $2,341.74 at an astronomically high 10.30% interest rate. He had already been offered a loan modification which he wasn't able to afford, and his home was about to be sold in foreclosure if he didn't do something quickly. However, this homeowner's situation changed completely in the months after he retained our firm this February 2013.

A newly single Florida homeowner had endured a financial hardship for nearly half a decade, and by the time he was able to begin picking up the pieces, he was 5 years and over $156,000 behind on his mortgage payments to Ocwen Financial. This homeowner was locked into a monthly mortgage payment of $2,341.74 at an astronomically high 10.30% interest rate. He had already been offered a loan modification which he wasn't able to afford, and his home was about to be sold in foreclosure if he didn't do something quickly. However, this homeowner's situation changed completely in the months after he retained our firm this February 2013.

[fa icon="clock-o"] Saturday, July 27, 2013 [fa icon="user"] Jake Sterling [fa icon="folder-open'] loan modification attorney, loan modification, successful loan modifications

Read More »What is a Credit Profile?

Your credit profile is a history of your credit behavior. Your credit history is compiled by credit reporting agencies that receive your financial information from certain creditors. It is worth noting that not every creditor reports financial information to the credit reporting agencies, however, most major banks and companies that grant credit to consumers do report financial information regarding their customers to the credit reporting agencies. The credit reporting agencies use the financial information about a consumer to formulate a credit score. Many lenders and companies that grant credit to consumers utilize consumer credit scores to determine if they will grant credit and how much credit they are willing to grant. Sometimes interest rates on loans are determined by lenders based upon the borrower’s credit score.

[fa icon="clock-o"] Friday, July 26, 2013 [fa icon="user"] Jake Sterling [fa icon="folder-open'] understanding credit

Read More »- Do you know what's the best thing to do after receiving a foreclosure notice?

- Do you understand how long it takes to foreclose on a house in New York?

- Are you prepared to deal with New York's foreclosure process?

If you weren't sure how to answer any of these questions, then you should take half a minute to download the New York foreclosure timeline, especially if you're at risk for foreclosure or if you're already involved in the foreclosure process.

If you weren't sure how to answer any of these questions, then you should take half a minute to download the New York foreclosure timeline, especially if you're at risk for foreclosure or if you're already involved in the foreclosure process.

[fa icon="clock-o"] Thursday, July 25, 2013 [fa icon="user"] Jake Sterling [fa icon="folder-open'] new york foreclosure attorney

Read More »

[fa icon="clock-o"] Wednesday, July 24, 2013 [fa icon="user"] Kristen Clinton [fa icon="folder-open'] foreclosure defense, short sale

Read More »

- What's the best thing to do immediately after getting a foreclosure notice?

- How long does it take to foreclose on a home in New Jersey?

- Are you completely ready to deal with the foreclosure process in New Jersey?

If you can't confidently answer all these questions, then you should take a few seconds to download the New Jersy foreclosure timeline, especially if you think you may be at risk for foreclosure or are already within the foreclosure process.

[fa icon="clock-o"] Tuesday, July 23, 2013 [fa icon="user"] Jake Sterling [fa icon="folder-open'] new jersey foreclosure attorney, new jersey foreclosure process

Read More »

House vs. Home

We understand that you probably have an emotional attachment to your home, but is it time to start looking at your home as a house or an investment?

[fa icon="clock-o"] Monday, July 22, 2013 [fa icon="user"] Jake Sterling [fa icon="folder-open'] stop foreclosure, how to stop foreclosure, loan modification help

Read More »Disclaimer: These results should not be taken as a guarantee, as each case is unique. We have helped over 5,000 homeowners, here is one of their stories. A Florida homeowner was having difficulty paying his monthly mortgage payment and was fearful of losing his home. His fear was well-founded, because he was nearly 1.5 years behind and over $52,000 past due on his monthly mortgage payments to Bank of America. This situation was further exasperated by the high cost of his monthly payment: nearly $3,400 monthly.

A Florida homeowner was having difficulty paying his monthly mortgage payment and was fearful of losing his home. His fear was well-founded, because he was nearly 1.5 years behind and over $52,000 past due on his monthly mortgage payments to Bank of America. This situation was further exasperated by the high cost of his monthly payment: nearly $3,400 monthly.

[fa icon="clock-o"] Saturday, July 20, 2013 [fa icon="user"] Jake Sterling [fa icon="folder-open'] loan modification attorney, loan modification, successful loan modifications

Read More »

Learn How the Fair Debt Collection Practices Act Protects You From Harassment by Debt Collectors

Mortgage lenders and other debt collectors are well-known for harassing people with consistent, annoying phone calls and threatening messages. Most people don't know that there are laws in place to protect them from these phone calls. The Fair Debt Collection Practices Act (hereinafter referred to as “FDCPA") limits the timing and recurrence of phone calls from creditors, and also gives consumers the ability to opt out of debt collection calls with a simple cease-and-desist letter. It's disappointing that more people don't take advantage of these consumer protection laws.

[fa icon="clock-o"] Friday, July 19, 2013 [fa icon="user"] Jake Sterling [fa icon="folder-open'] bank of america loan modification problems, mortgage fraud

Read More »

Liberate Yourself From Foreclosure

The truth is that you have a good probability of successfully defending against foreclosure on your home. However, the majority of Pennsylvania residents do not fight to keep their homes. Why?

They do not believe that effective action can be taken to save their homes or avoid foreclosure. Pennsylvania homeowners have several foreclosure help options, which can improve the chances of staying in your home.

If you are on the verge of falling behind on your mortgage payments or have entered the foreclosure timeline, here are the most common foreclosure defense options to help you avoid foreclosure and deficiency judgment

[fa icon="clock-o"] Wednesday, July 17, 2013 [fa icon="user"] Jake Sterling [fa icon="folder-open'] pennsylvania foreclosure defense, loan modification attorney, prolong foreclosure

Read More »

Foreclosures broke records in the years following the 2007 subprime lending crash and housing market collapse. Many industry watchers used the word "crisis" to describe the rapid increase of foreclosures. Illinois is one of many states to try to address the problem with legislation to help protect struggling homeowners. While homeowners do have a better opportunity to stop foreclosure in Illinois with the new laws, as you might expect, there are complexities. Typically, a homeowner's best option is to hire an attorney experienced with foreclosure defense in Illinois.

[fa icon="clock-o"] Monday, July 15, 2013 [fa icon="user"] Jake Sterling [fa icon="folder-open'] stop foreclosure, illinois foreclosure lawyer

Read More »Disclaimer: these results should not be construed as a guarantee, as each case is unique. We have helped over 5,000 homeowners, here is one of their stories. A mature, single Florida homeowner was having difficulties making her mortgage payment, because of limited income from social security. She was even renting out one of her bedrooms. It just wasn't enough to make ends meet. When she retained our law firm, she hadn't paid her mortgage in over 10 months, she owed her lender—Nationstar Mortgage—over $8,000 dollars, and her home was in the foreclosure process. No foreclosure sale date had been set yet.

A mature, single Florida homeowner was having difficulties making her mortgage payment, because of limited income from social security. She was even renting out one of her bedrooms. It just wasn't enough to make ends meet. When she retained our law firm, she hadn't paid her mortgage in over 10 months, she owed her lender—Nationstar Mortgage—over $8,000 dollars, and her home was in the foreclosure process. No foreclosure sale date had been set yet.

[fa icon="clock-o"] Saturday, July 13, 2013 [fa icon="user"] Jake Sterling [fa icon="folder-open'] loan modification attorney, loan modification, successful loan modifications

Read More »

Pets Left Behind and Forgotten – Victims of Foreclosure

They can't speak for themselves: poor defenseless animals abandoned and left behind in foreclosed homes. It's a bigger issue than people realize, a serious consequence of the foreclosure nightmare.

Many homeowners do consider turning their pets into animal shelters, but due to overpopulation at many shelters, almost half of incoming animals are euthanized. Heartless homeowners sometimes leave pets in their abandoned homes without food or water, not to mention a non-temperature-controlled environment. Veterinarians say a dog or cat will become dehydrated within 24 hours without water and could die a slow, painful death within a few days.

Why or How Can Foreclosed Homeowners Abandon Pets?

[fa icon="clock-o"] Friday, July 12, 2013 [fa icon="user"] Jake Sterling [fa icon="folder-open'] stop foreclosure

Read More »

- Do you know what to do after being served with a foreclosure notice?

- Do you understand how long foreclosure takes in Pennsylvania?

- Are you prepared to confront every twist and turn of Pennsylvania's foreclosure process?

[fa icon="clock-o"] Wednesday, July 10, 2013 [fa icon="user"] Jake Sterling [fa icon="folder-open'] pennsylvania foreclosure defense

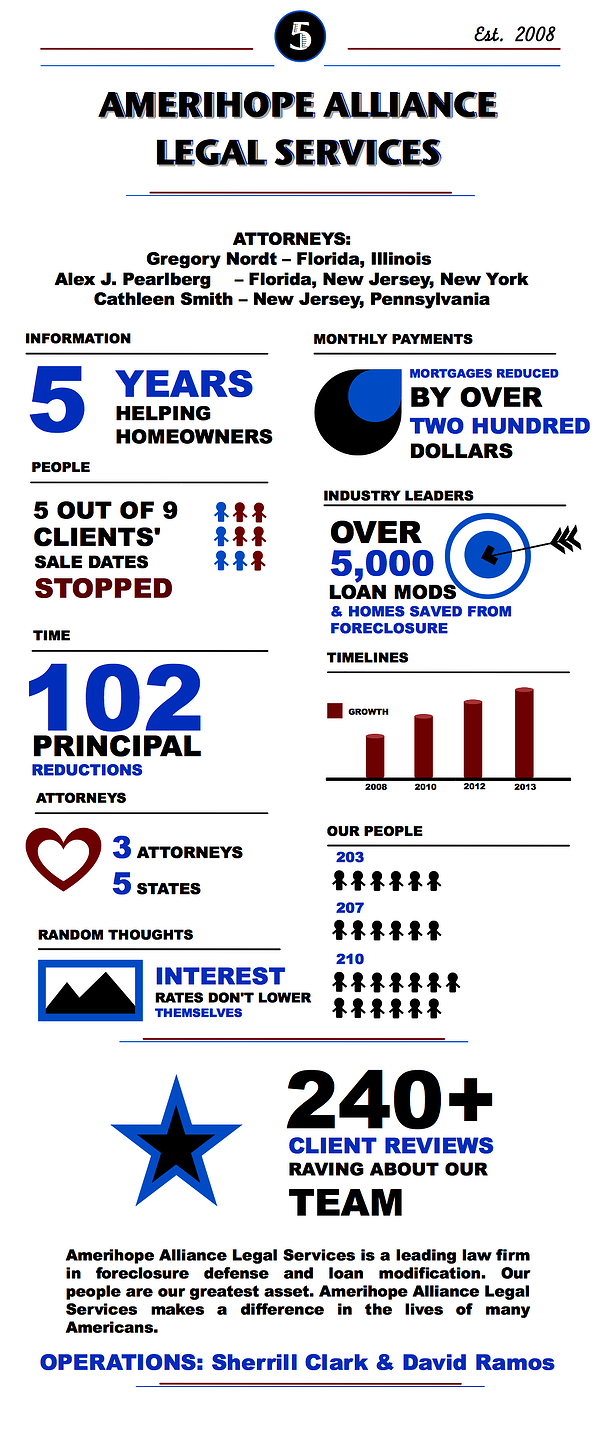

Read More »In 5 years, Amerihope Alliance Legal Services has accomplished a LOT. We have completed over 5,000 loan modifications for our clients, stopped countless foreclosures. Many homeowners are back on their feet because they chose to retain the foreclosure defense lawyers at our firm.

Click through to see the graphic.

[fa icon="clock-o"] Monday, July 8, 2013 [fa icon="user"] Jake Sterling [fa icon="folder-open'] loan modification, foreclosure defense

Read More »

To celebrate our 5 year anniversary, we ran a contest in the office. Employees were invited to submit a poem, story, song or picture. Here are our winners!

Winner: Ruth Gross

There was a nice woman

Who lived in a shoe,

She had so many bills,

She didn't know what to do.

She went to Amerihope

With her fears and her dreams,

And with a smile and some work,

They saved her home that sat by a stream.

Her family is now happy

And is able to cope.

She said, "Thank you Lord,

For sending me to Amerihope"

She then kissed all her children

And made sure they were fed

And when they were done,

She tucked them all in bed.

Runner Up: Joe Mizzell

Amerihope Mod Song

[fa icon="clock-o"] Friday, July 5, 2013 [fa icon="user"] Jake Sterling [fa icon="folder-open'] bank of america loan modification, loan modification, foreclosure defense

Read More »

- Do you know what's the first step to take after receiving a foreclosure notice?

- Do you know how long the foreclosure process takes in Illinois?

- Do you know what to expect from the foreclosure process?

If you answered “no” to any of these questions, then you should invest 2 minutes into downloading the Illinois foreclosure timeline, especially if you are at risk for foreclosure or if you are already within the foreclosure process.

[fa icon="clock-o"] Wednesday, July 3, 2013 [fa icon="user"] Jake Sterling [fa icon="folder-open'] illinois foreclosure lawyer

Read More »Every Homeowner In Your State Deserves a Homeowner Bill of Rights. Here's Why.

California was once one of the worst places to experience foreclosure, but now it is a model state for giving homeowners a a fair shake against their mortgage lenders. One single piece of legislation is responsible for this change; that legislation is the Homeowner Bill of Rights. California's Homeowner Bill of Rights formally took effect at the beginning of 2013. According to the California Attorney General's Office, the Bill of Rights "ensures fair lending and borrowing practices for California homeowners... these laws are designed to guarantee fairness and transparency for homeowners within the foreclosure process."

California was once one of the worst places to experience foreclosure, but now it is a model state for giving homeowners a a fair shake against their mortgage lenders. One single piece of legislation is responsible for this change; that legislation is the Homeowner Bill of Rights. California's Homeowner Bill of Rights formally took effect at the beginning of 2013. According to the California Attorney General's Office, the Bill of Rights "ensures fair lending and borrowing practices for California homeowners... these laws are designed to guarantee fairness and transparency for homeowners within the foreclosure process."

[fa icon="clock-o"] Monday, July 1, 2013 [fa icon="user"] Jake Sterling [fa icon="folder-open'] loan modification, foreclosure defense

Read More »