Disclaimer: These results should not be taken as a guarantee, as each case is unique. We have helped over 7,000 homeowners. Here are a few of their stories.

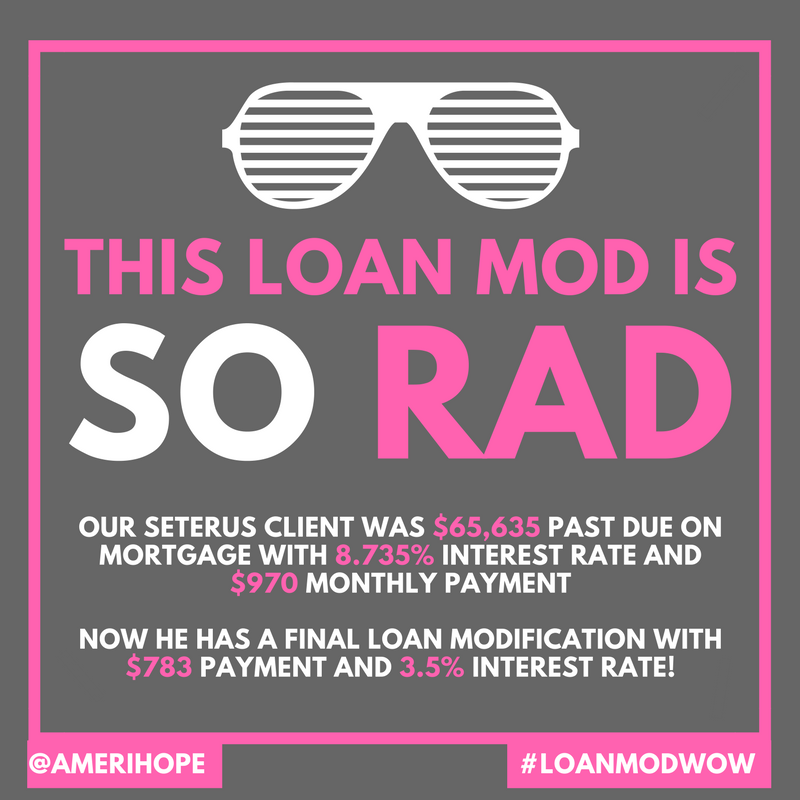

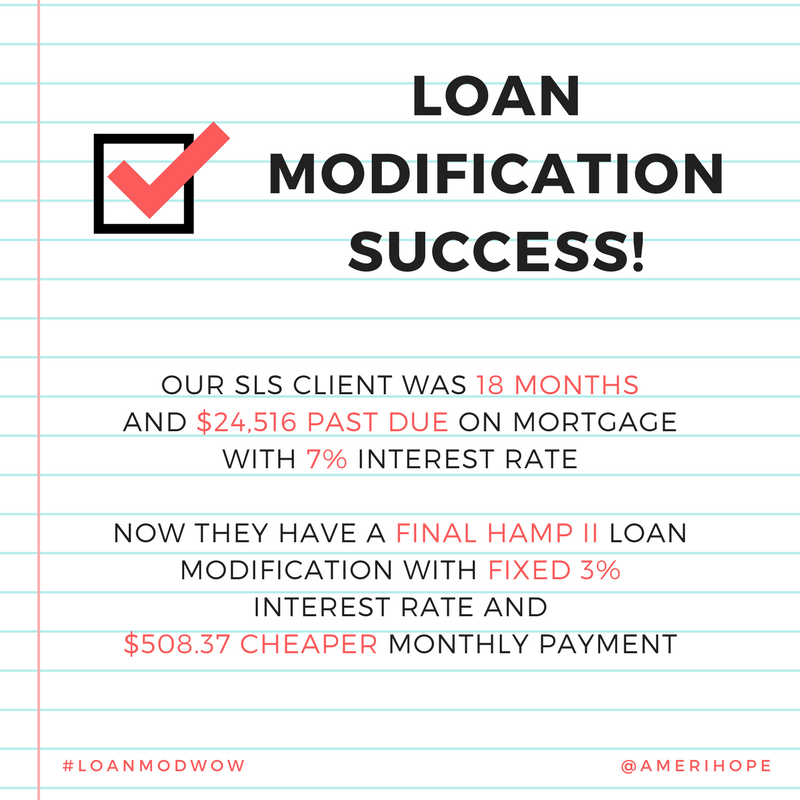

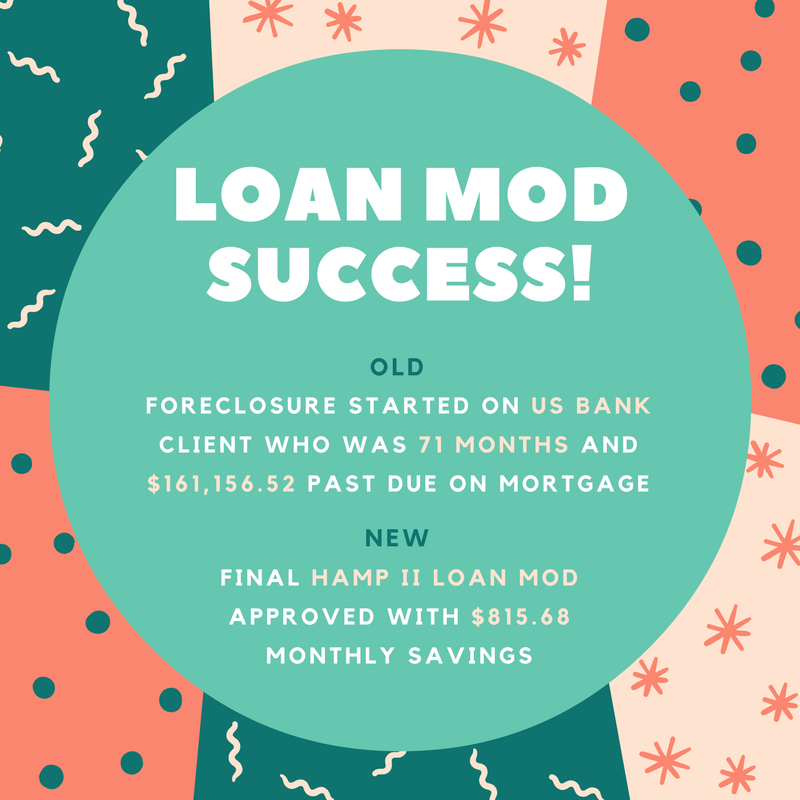

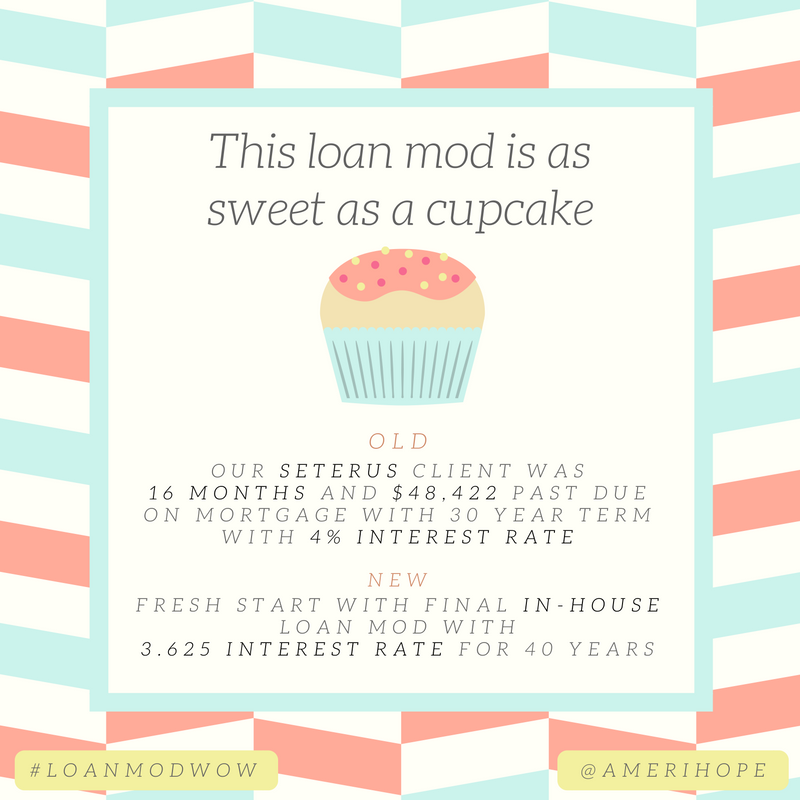

Every week we obtain loan modifications for our clients with a variety of loan servicers. You can see these results as they are announced on Twitter (#loanmodwow) or Facebook. Here are some of our results from this week with SLS, Ocwen, SPS, Regions Bank, and Seterus:

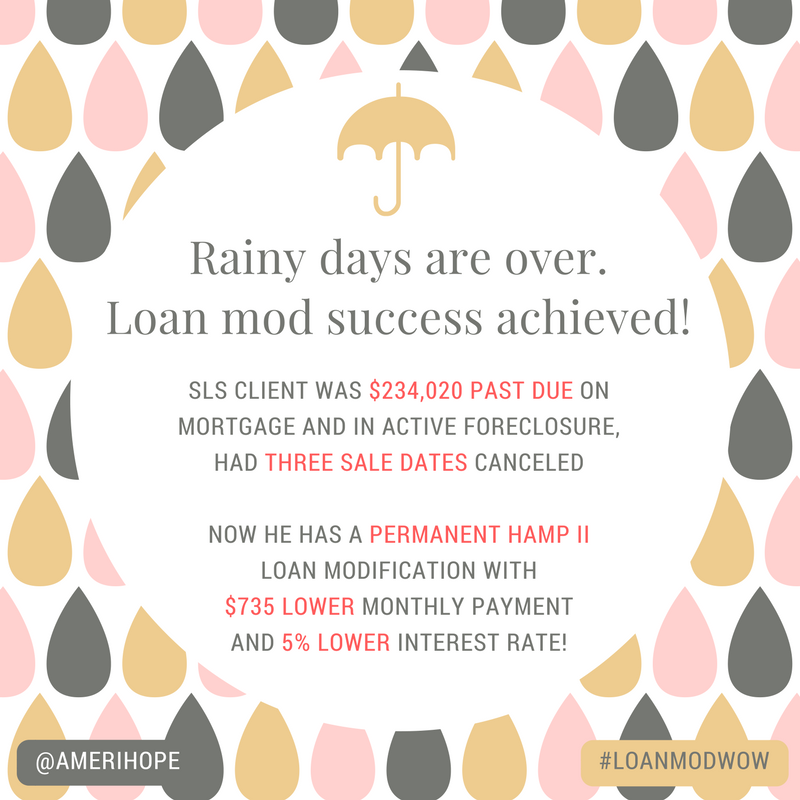

SLS

$234,020 past due on mortgage with SLS, our client was in active foreclosure and had three sale dates canceled, now has a permanent HAMP II loan modification with $735 lower monthly payment and 5% lower interest rate!