Foreclosure can be a confusing subject that mystifies all but the most well-versed professionals. All the ins and outs, the what have yous, and esoteric legal language make it difficult to understand the benefits and requirements of various options. However, there are ways to stop foreclosure that are simple and easy to understand for any homeowner. One of the easiest ways is a revolutionary concept that involves paying the money required to bring the loan current. It's called reinstatement.

[fa icon="clock-o"] Monday, December 7, 2015 [fa icon="user"] Maxwell Swinney [fa icon="folder-open'] loan modification, foreclosure, reinstatement

Read More »

The Hardest Hit Fund (HHF) was created by the federal government in 2010 to give financial aid to struggling homeowners in states that were most negatively impacted by the housing crisis and recession through loan modifications, mortgage payment assistance, and transition assistance programs. States were selected to receive funds from the program based on having above average rates of unemployment and decline in housing prices.

[fa icon="clock-o"] Friday, December 4, 2015 [fa icon="user"] Maxwell Swinney [fa icon="folder-open'] loan modification, hardest hit

Read More »

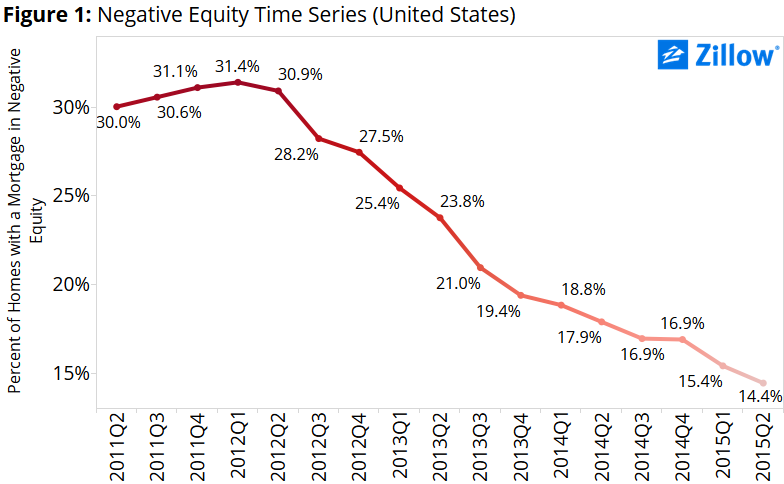

The percentage of Americans with negative equity in their homes, also known as being underwater, continued to fall in the second quarter of 2015 to 14.4%, according to a report from the real estate company Zillow. The rate of homeowners with negative equity has been dropping since the first quarter of 2012 when a high of 31.4% of homeowners were underwater.

[fa icon="clock-o"] Wednesday, December 2, 2015 [fa icon="user"] Maxwell Swinney [fa icon="folder-open'] loan modification, housing market, negative equity

Read More »

Mortgage servicers are the companies that many borrowers make their mortgage payments to. They may not be the same company as your originating lender and the owner of your loan. Servicers have many responsibilities for managing a mortgage, including:

[fa icon="clock-o"] Monday, November 30, 2015 [fa icon="user"] Maxwell Swinney

Read More »

Each Thanksgiving we're all supposed to give thanks for the good things that have happened to us over the course of the year. It's a time to show appreciation and gratitude while enjoying a big meal with family and friends. A turkey is pardoned by the president, and we're all encouraged to relax and enjoy ourselves. But the troubles and difficulties of life don't take a day off just because you do. Concerns about bills, career, and relationships remain even as the focus is supposed to be exclusively on the positive.

[fa icon="clock-o"] Wednesday, November 25, 2015 [fa icon="user"] Maxwell Swinney [fa icon="folder-open'] foreclosure defense, foreclosure

Read More »

Unless you live under a rock, you have heard that the United States experienced a rapid and significant increase in home prices and construction in the first decade of the 21st century (the aughts) that turned out to be a bubble, which burst, leading to a recession. If you're a homeowner with a mortgage, you probably experienced some uneasiness as you watched the value of your home fall along with your investments and just about everything else of value you own. Fortunately, things have slowly improved over the last few years, but some are concerned that we're making the same mistakes all over again. Are we just inflating another housing bubble that will burst and have the same, or worse consequences?

[fa icon="clock-o"] Monday, November 23, 2015 [fa icon="user"] Maxwell Swinney [fa icon="folder-open'] housing market

Read More »

Foreclosure starts were up 12% from the previous month in October 2015, according to real estate information company RealtyTrac's U.S. Foreclosure Market Report. RealtyTrac says the October increase in foreclosure starts is not a surprise this year since it has also happened the last five Octobers. What is a surprise is how much of a rise there was this October, which was more than twice the average rate of 5%.

[fa icon="clock-o"] Friday, November 20, 2015 [fa icon="user"] Maxwell Swinney [fa icon="folder-open'] foreclosure defense, foreclosure

Read More »

If your lender is threatening to foreclose on you for missed mortgage payments and you don't have the money to get current, and aren't eligible for a loan modification, you may be a candidate for a deed in lieu of foreclosure agreement. A deed-in-lieu of foreclosure agreement is when the borrower agrees to give ownership of their home to the lender in exchange for canceling their mortgage.

[fa icon="clock-o"] Wednesday, November 18, 2015 [fa icon="user"] Maxwell Swinney [fa icon="folder-open'] short sale, foreclosure deficiency, foreclosure, deed in lieu of foreclosure

Read More »

Beginning in 2014, the Consumer Financial Protection Bureau (CFPB) established new rules to protect homeowners facing foreclosure from unnecessary expenses and surprises. Among the rules are restrictions on the mortgage servicer's ability to pursue foreclosure while reviewing your application for a loan modification, a practice known as dual-tracking.

[fa icon="clock-o"] Monday, November 16, 2015 [fa icon="user"] Maxwell Swinney [fa icon="folder-open'] loan modification, loan modification help, dual-tracking, foreclosure

Read More »

Foreclosure does not just impact the place you sleep and keep all your belongings. It could also have a negative effect on your physical and mental health. Studies have shown that people who have fallen behind on their mortgage are more likely to report symptoms of depression and skip medication because of a lack of money. Sadly, the sharp increase in foreclosures since the Great Recession began has also coincided with an increase in suicide.

So, literally and figuratively, foreclosure can kill you. Though tragic, it shouldn't come as a great surprise. The threat of foreclosure is extremely stressful and often occurs following a severe hardship such as loss of employment, death in the family, or a medical problem.

Experiencing a hardship like a serious medical problem can be outrageously expensive, and cause a person to miss work or lose their job. The cost of the medical care and lost income can lead to trouble making mortgage payments, and the stress of potentially losing your home can be severe enough to cause depression, which makes getting out of the hole you're in even more difficult. It's a viscous cycle that's hard for many people to get out of.

[fa icon="clock-o"] Friday, November 13, 2015 [fa icon="user"] Maxwell Swinney [fa icon="folder-open'] foreclosure defense, foreclosure

Read More »