Experts agree that if you're confronted with mortgage trouble, a loan modification is the first option you should consider if your goal is to keep your home. A short sale is an option for a homeowner who is upside-down and can't afford or doesn't want to keep their home. Foreclosure is never an "option" for homeowners and for the most part only affects homeowners who put their head in the sand and ignore all the available options.

Simply speaking, mortgage modifications offer far fewer consequences for a homeowner's financial future when compared to short sale and foreclosure, and offer the distinct advantage of allowing a homeowner to stay in his or her home.

What Happens When it's Over?

Perhaps the greatest advantage of loan modifications are that they allow homeowners to stay in their home. With loan modification, homeowners won't have to worry about the physical, mental, emotional, and financial stress that comes with being forced to leave their home and attempting to find another place to live. Instead, they'll be able to keep their roots right where they are.

After a homeowner executes a short sale on his or her house, moving into a home becomes the first step in building your new life. After a short sale, many homeowners rent for a few years while rebuilding their credit before being able to qualify for a new loan and feeling "ready" for homeownership again.

Foreclosure creates more stress on a homeowner than a short sale. If a homeowner wishes to purchase a home after foreclosure, then he or she may have to wait as long as 7 years to qualify for a new mortgage. Also, foreclosure most likely will have to be reported on all of a homeowners' future loan applications, which can prove to be a hindrance when seeking a new mortgage. Some analysts suggest that in the next few years, some leeway will be granted to homeowners who have been through foreclosure.

Consequences on Credit Scores

Fair Isaac released a report that says credit scores are affected about the same, whether a seller does a short sale or foreclosure. Fair Issac says the average points lost on a FICO score are as follows:

- 30 days late: 40 to 110 points

- 90 days late: 70 to 135 points

- Foreclosure, short sale or deed-in-lieu: 85 to 160

- Bankruptcy: 130 to 240

A foreclosure will remain listed on your credit report as "foreclosure" for 7 years, and becomes part of your permanent civil record. After a short sale, the way it is recorded on your credit report depends on who your lender is (however it isn't specifically recorded as a "short sale"). A short sale can stay on your credit report for 2-3 years.

Loan modifications, on the other hand, can have little comparative effect on your credit score, depending on your current credit standing. They do not become part of your permanent public record, but any foreclosure proceedings might appear.

Can Short Sale or Foreclosure Affect Your Employment Prospects?

Foreclosure's negative effects may extend to the workplace. Foreclosure can negatively affect a homeowners' work life by negatively affecting government security clearance checks. Foreclosure, or even poor credit, can affect applicants in certain fields of employment. Short sales, don't show up on the majority of security clearance checks, but may still affect certain higher-clearance positions. Keep in mind that today, security clearances are no longer only used by the military or law enforcement; industries ranging from telecom to software development to firefighting all require security clearance today.

If you are applying for a job in the future, you may be asked to explain the blemish in your credit history. Due to the surge in foreclosures, loan modification, and a short sales, we believe these financial crises will be given much less emphasis in the future.

Deficiency Judgments

During a short sale, homeowners are able to negotiate against the prospect of a deficiency judgment. A homeowner is certainly not guaranteed to win against the big banks' powerful negotiators, but deficiency waivers are becoming more common. It is very important to look for this in your Short Sale Agreement.

In most states, homeowners don't have that right after a foreclosure, which gives their lender the right to seek a deficiency judgment from their lender. Of course, a homeowner who has received a loan modification does not have to worry about the prospect of deficiency judgment, because they are still paying for their home.

The Big Picture

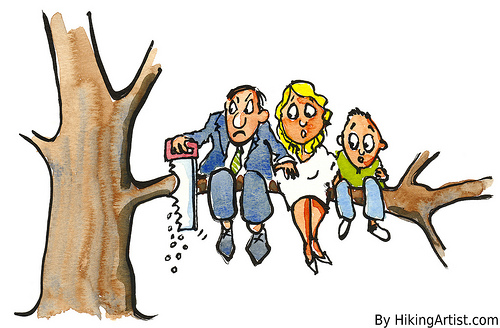

It's easy to tell why experts recommend loan modification for homeowners in financial trouble instead of short sale or foreclosure. Loan modification presents fewer negative future consequences than the other options. However, it's not as cut-and-dry as it may seem. Certain homeowners don't wish to stay in their homes, or fight for a loan modification or don't accept the loan modifications they've been offered. Those homeowners are often prime candidates for short sale.

For homeowners in financial trouble, the best way to be completely worry-free now and in the future is through a combined strategy of foreclosure defense and loan modification. There are a select few law firms that offer foreclosure defense with loan modification as an ancillary service. In other words, they will defend your home against foreclosure and work with your bank to get you a loan modification. This method of foreclosure defense offers the best chance at a great financial future.

photo credit "head in the sand": tropical.pete via photopin cc

photo credit consequences: HikingArtist.com via photopin cc