Disclaimer: These results should not be taken as a guarantee, as each case is unique. We have helped over 7,000 homeowners. Here are some of their stories.

Disclaimer: These results should not be taken as a guarantee, as each case is unique. We have helped over 7,000 homeowners. Here are some of their stories.

Every week we obtain loan modifications for our clients with a variety of loan servicers. You can see these results as they are announced on Twitter (#loanmodwow) or Facebook. Here are some of our results from this week with Rushmore, Ocwen, Gregory Funding, Carrington:

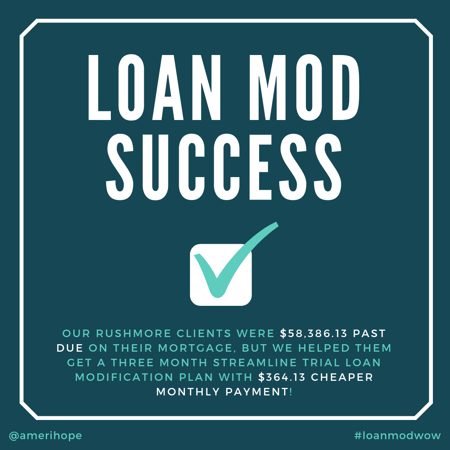

Rushmore

Our Rushmore clients were $58,386.13 past due on their mortgage, but we helped them get a three month streamline trial loan modification plan with $364.13 cheaper monthly payment!

Ocwen

Our Ocwen clients were $7,024.07 past due on their mortgage, but we helped them get a 3 month trial loan modification with $160.79 cheaper monthly payment, a 20% savings!

Our Ocwen clients were $7,024.07 past due on their mortgage, but we helped them get a 3 month trial loan modification with $160.79 cheaper monthly payment, a 20% savings!

Our Ocwen clients were 6 months and $14,189.80 past due on their mortgage, but we helped them get a 3 month streamline trial loan modification plan with $361.78 monthly savings and $49,493.57 interest free deferment!

Gregory Funding

More than $98,646.92+ fees past due on her mortgage, which had been modified before, we helped our Gregory Funding client get another loan modification that allows her to keep her home and avoid foreclosure!

Carrington

Carrington client was 15 months and $12,246 past due on his VA mortgage, which was modified in 2012, but we helped him get a fresh start with a permanent loan modification!