When your bank serves you with a foreclosure complaint for not paying your mortgage, you have a right to answer it and deny its charges, which you should.

When your bank serves you with a foreclosure complaint for not paying your mortgage, you have a right to answer it and deny its charges, which you should.

You should also include something called affirmative defenses in your response to the complaint because they are a vital part of a good foreclosure defense strategy.

What Is An Affirmative Defense?

An affirmative defense in a civil lawsuit is a fact that defeats or mitigates the consequences of a charge. For example, in a foreclosure complaint the plaintiff will charge that you haven't been paying your mortgage and they're entitled to foreclose because of that. An affirmative defense wouldn't deny that (though the answer probably would), but it would basically say that it doesn't matter for some reason, like the plaintiff doesn't have the right to foreclose.

There are many different affirmative defenses that can be used when responding to a foreclosure complaint. If you fall into foreclosure, you can write your own response to the complaint, but it would be best to have an experienced attorney do it as they will know which affirmative defenses are relevant for your case.

Some of the most common affirmative defenses used in foreclosure cases are:

Lack of standing

The plaintiff (bank) must prove that they are the ones legally entitled to foreclose on you. That, in legal terminology, is called standing. The bank's errors, improper or incomplete documentation, or fraud may cause them to have a hard time proving their standing. And most states require the plaintiff to own and hold the mortgage and note at the time they sue. If their documents don't show that they did, they can't take your property.

The plaintiff (bank) must prove that they are the ones legally entitled to foreclose on you. That, in legal terminology, is called standing. The bank's errors, improper or incomplete documentation, or fraud may cause them to have a hard time proving their standing. And most states require the plaintiff to own and hold the mortgage and note at the time they sue. If their documents don't show that they did, they can't take your property.

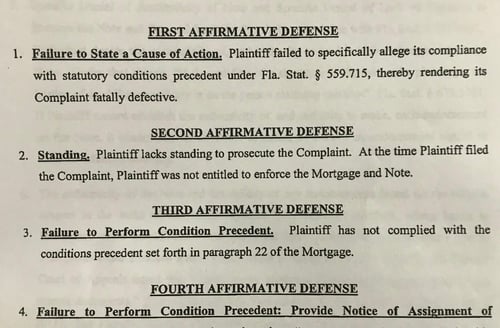

Our firm routinely includes a lack of standing affirmative defense when answering foreclosure complaints. Here is an excerpt of us raising it for a Florida client:

"SECOND AFFIRMATIVE DEFENSE

Standing. Plaintiff lacks standing to prosecute the Complaint. At the time Plaintiff filed the Complaint, Plaintiff was not entitled to enforce the Mortgage and Note."

Failure of Condition Precedent

If the plaintiff fails to comply with the requirements in the mortgage contract, such as to serve the defendant with a notice of default or intent to accelerate as stated in the mortgage contract, they may have to start the process over.

Unfair Lending Practices

If your lender deceived you, acted unfairly, or failed to disclose required information, you may be able to challenge foreclosure because of it. The federal Truth In Lending Act (TILA) requires lenders to disclose the annual percentage rate, payment schedule, and other information about the loan. Lenders who do not give borrowers the correct information TILA requires have broken this law.

Not the real party in interest

When a mortgage loan is made, there is a promissory note that is the borrower's responsibility to pay back, and the security interest that the lender has in the property in the form of a mortgage or deed of trust. Whoever is assigned the note and mortgage is the one with the right to foreclose. Problems arise when the mortgage and note are assigned to servicers, trustees, or holders and the right documentation or original note can't be found. If the ownership of your mortgage isn't clear, you may be able delay foreclosure.

Unclean hands

Unclean hands is when “the defendant argues that the plaintiff is not entitled to obtain an equitable remedy because the plaintiff is acting unethically or has acted in bad faith with respect to the subject of the complaint —that is, with “unclean hands”. The defendant has the burden of proof to show the plaintiff is not acting in good faith. The doctrine is often stated as “those seeking equity must do equity” or “equity must come with clean hands”.”

Unclean hands is when “the defendant argues that the plaintiff is not entitled to obtain an equitable remedy because the plaintiff is acting unethically or has acted in bad faith with respect to the subject of the complaint —that is, with “unclean hands”. The defendant has the burden of proof to show the plaintiff is not acting in good faith. The doctrine is often stated as “those seeking equity must do equity” or “equity must come with clean hands”.”

An unclean hands defense could be used in a foreclosure case if it could be proven that the plaintiff (the bank) caused the default and is therefore not entitled to an equitable remedy. An example of unclean hands could be if your loan servicer doesn't properly apply your mortgage payments to your loan, and you fall into foreclosure because of it. They would have unclean hands since it was their fault you are in foreclosure.

Other affirmative defenses include: Unfair lending practices, failure to state a cause of action, unconscionable terms, foreclosing on an active service member, failure to properly invoke the court's subject matter jurisdiction, verification of complaint, statutes of limitations, contributory negligence, assumption of risk, and failure to mitigate damages.

You have rights under the law that can help you fight foreclosure, but they won't help you if you don't know what they are and how to use them. Again, it would be best to have an experienced attorney help you respond to a foreclosure complaint so you use the right affirmative defenses.

And keep in mind that affirmative defenses probably aren't going to keep you out of foreclosure forever. For that, you'll need to look at a permanent solution such as a loan modification.