Disclaimer: These results should not be taken as a guarantee, as each case is unique. We have helped over 7,000 homeowners. Here are some of their stories.

Every week we obtain loan modifications for our clients with a variety of loan servicers. You can see these results as they are announced on Twitter (#loanmodwow) or Facebook. Here are some of our results from this week with Bayview and Freedom Mortgage:

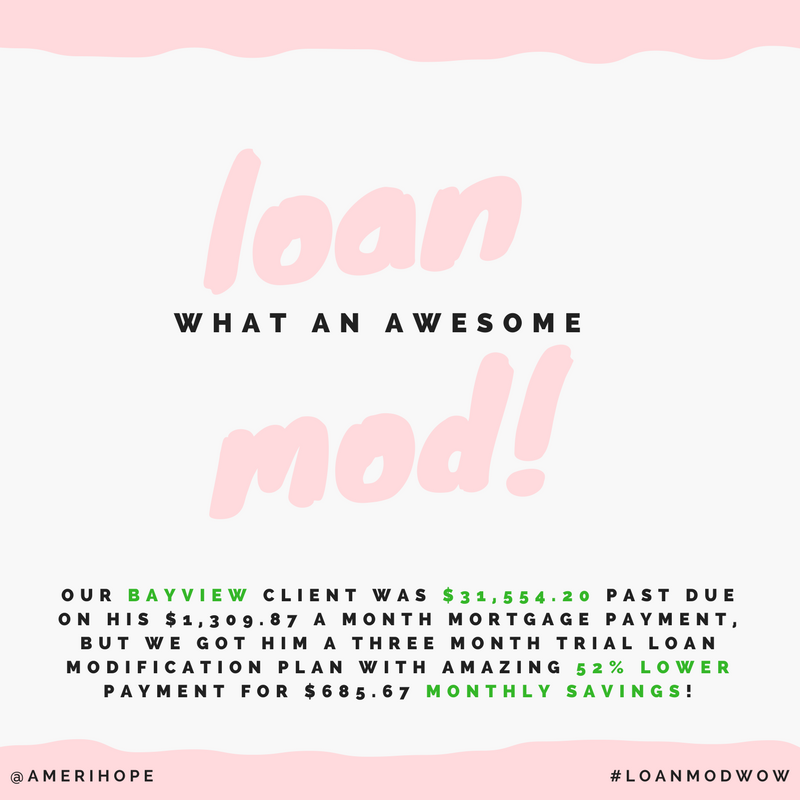

Bayview

23 months and $41,642+fees past due on their mortgage (which had been previously modified) with a foreclosure sale date set, we helped our Bayview clients get a three month trial loan modification plan with a fresh start!