Disclaimer: These results should not be taken as a guarantee, as each case is unique. We have helped over 7,000 homeowners. Here are a few of their stories.

Disclaimer: These results should not be taken as a guarantee, as each case is unique. We have helped over 7,000 homeowners. Here are a few of their stories.

Every week we obtain loan modifications for our clients with a variety of loan servicers. You can see these results as they are announced on Twitter (#loanmodwow) or Facebook. Here are some of our results from this week with Nationstar, Shellpoint, Wells Fargo, Ocwen, and Ditech:

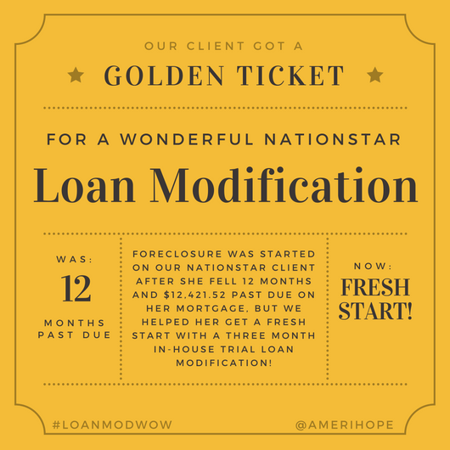

Nationstar

Foreclosure was started on our Nationstar client after she fell 12 months and $12,421.52 past due on her mortgage, but we helped her get a fresh start with a three month in-house trial loan modification. If she keeps up her payments, we hope to have her in a permanent modification by Easter!

Our Nationstar clients were $28,107.72 past due on their mortgage payments, but now they have a final loan modification with the entire past due amount deferred and monthly savings of $224.03 (24% reduction)!

Shellpoint

Christmas came early for our Shellpoint client who was just approved for a final loan modification with $465.66 lower monthly mortgage payment and $97,397.57 deferred after he fell more than a year and $29,249 past due on his mortgage!

Wells Fargo

Our Wells Fargo client was past due on his mortgage, but thanks to our help, he now has a final loan modification with massive $679.53 cheaper monthly payment and $5,600.94 deferred for 40 years!

Ocwen

Our Ocwen client was 20 months and $22,627 past due on mortgage payments, but now has a final in-house loan modification with $193.53 monthly savings and $58,540.19 non-interest bearing deferment!

Ditech

Our Ditech clients were 22 months and $68,594+ past due on their mortgage, now they have a final in-house loan modification with a fresh start!