Disclaimer: These results should not be taken as a guarantee, as each case is unique. We have helped over 7,000 homeowners, here is one of their stories.

In March 2014 we were hired by a homeowner in Trenton NJ, whom I'll call Ramon Delgado to protect his privacy, who needed help saving his  home from foreclosure.

home from foreclosure.

Mr. Delgado, like most homeowners, didn't want to default on his mortgage with Citi, but a significant loss of income forced him into a situation where he couldn't make his house payments.

He was able to recover from his hardship and regain the ability to pay his mortgage. However, after falling so far behind, Citi didn't want him to resume making regular mortgage payments. They wanted a big check for all the missed payments plus fees, which he didn't have the cash to do. So he remained in default even though he could have made payments. This is a common scenario.

By spring 2014, Mr. Delgado hadn't made a house payment in almost three years. He was lucky his home hadn't been sold in a sheriff's sale after going so long without making a payment. It happens like that sometimes, but eventually your luck will run out and the bank will move the foreclosure case forward.

Download a New Jersey Foreclosure Timeline

Our client recognized that not paying his mortgage and keeping his home were like oil and water, they didn't mix. Not forever, anyway. So he hired us to help him find a permanent solution.

Applying For Loan Modification

Since Ramon didn't have the money to reinstate his mortgage, a loan modification was the only option that allowed him to avoid foreclosure and keep his home.

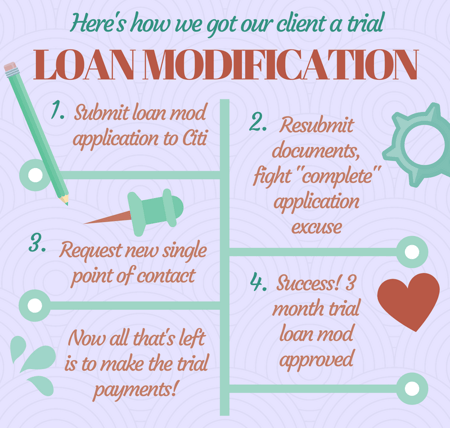

We got to work gathering all the documents needed to apply for a loan modification. It's an extensive process that requires a lot of paperwork, including documentation of income, tax returns, bank statements, and a hardship letter.

Loan Mod Limbo

Our senior paralegal describes Citi as "fairly decent" when moving cases along for loan modification review in his experience. Unfortunately that was not the case for Mr. Delgado. Citi refused to review his application by claiming that it wasn't complete because the documents in it weren't up to date.

This has been called the “complete” application scam, where a mortgage servicer takes advantage of the slightest (alleged) error or deficiency in the application as an excuse to deem it incomplete and thus unworthy of review. Servicers frequently claim that some documents are missing or not up to date. And when there's no application for loan modification under review, it's not dual-tracking when they foreclose.

Citi refused to review our client's application for months and eventually years, though they did finally serve him with foreclosure papers and set a sale date for his home. We were close to filing a formal complaint with the Consumer Financial Protection Bureau (CFPB), to try get Citi to stop jerking our client around and review the darn application. But there was something else we wanted to try first.

New Single Point of Contact

We were unhappy with the single point of contact at Citi assigned to our client's case, so we asked them to give us someone else.

Servicers are required to appoint a single point of contact (SPOC) for delinquent borrowers seeking a loan modification. This SPOC requirement came about as a result of the terrible service many borrowers were given when trying to get a loan modification or other loss mitigation option. Homeowners complained about having to speak to a different person every time they called their bank about saving their home and not getting consistent answers.

We told them there was no reason this file should be taking so long without being sent to an underwriter. (An underwriter is the person who analyzes the homeowner's income and determines if they qualify for a loan modification.)

These types of conversations between our staff and the bank and their attorneys sometimes get heated. We are willing to get testy with these people if that's what it takes. After all, our goal isn't to make friends, it's to get the best results for our clients.

Trial Modification Approved!

Our assertive request for a different single point of contact was granted and we were given a new one. After that things started to change. The file finally went to an underwriter. The sale date was adjourned and Mr. Delgado was approved for a three month trial loan modification. Now Mr. Delgado has a fresh start and he just needs make the three trial payments on time to have a permanent loan modification.

That's the way it's supposed to work. There are cases where the trial payments are made and the permanent loan mod isn't offered. Sometimes the bank asks for trial payments to go on for much more than three months. Mr. Delgado has us to badger Citi to demand that his rights are given to him.

It's unfortunate that it took so long for Citi to review this deserving client for a loan modification, but without our help they might never have before the home was lost in a sheriff's sale. That's why having good help from experienced professionals is so important.

* Update 8/3/2017 * Since this was originally published Mr Delgado successfully made his trial modification payments and was approved for a final loan modification.