If you have decided not to keep your house, one option that you may consider is a short sale. A short sale is the sale of a property in which the funds from the sale aren't enough to cover the balance of the existing mortgages owed. In a short sale, the lender agrees to release their mortgage on the property in exchange for the proceeds from the sale price of the house, even though they don't receive the full balance of the mortgage.

In a short sale, the market value of the property is often much lower than the amount owed on the home. Usually, the homeowner is struggling to make their mortgage payments or has missed mortgage payments. A short sale must be approved in advance by your lender, which is the main reason that some homeowners choose not to attempt a short sale.

Can I list my home "By Owner"?

You generally cannot list the home as “For Sale by Owner” if you want to attempt a short sale. Most lenders will REQUIRE you to list your house for sale with a Realtor. The Realtor must disclose in the MLS Listing that the home is classified as a short sale. All prospective buyers will know that your house is a potential foreclosure candidate. Some people do not feel comfortable with strangers coming into their house to view it with the knowledge that the homeowner is most likely in financial distress.

Who does a Short Sale benefit?

There are several parties the benefit from a short sale.

- You!

- Your existing mortgage lender (They save the time & expense of foreclosure and marketing the property to sell it).

- the Realtor (They will make a commission on the sale of your house)

- the purchaser of the property (They are most likely buying the house at below-market value).

How can it benefit me?

You may question does a short sale really benefit you and your family at all? Yes! You will have the house off your hands and be able to move on. You will no longer have the worry of paying for a mortgage that you can't afford, and you will feel relieved that you are in control of your finances again. You might even celebrate that you have released yourself from a bad investment.

Can a short sale hurt me?

Although there are many benefits to selling you home, it is still a weighty decision that need to be made. It is a choice that will affect your family's financial future. There are a few issues that you need to be aware of if you decide short sale your home.

- Your credit rating will be affected. A short sale affects your credit rating negatively, but not as harshly as a foreclosure.

- Short sale does not stop foreclosure. In spite of the short sale process, most lenders will continue the foreclosure process until the property is sold. Delinquent homeowners can have a foreclosure action filed against them even though they are attempting a short sale.

- Deficiency Judgment. When the short sale is completed and your property has been sold, your lender may still pursue a deficiency judgment against you. It is possible to negotiate a waiver of deficiency during the short sale process and you should consider discussing this protection with a real estate or foreclosure defense attorney.

- There is a lot of uncertainty with a Short Sale. Most short sales take three to six months (or more) to execute, but there isn't always a predictable timeline for you and your family to prepare yourself for the eventual move out of your house.

What happens in the short sale process?

Once you have an offer on the house, you as the short-seller, need to show the lender that you  can’t afford the property and that they are better off approving the short sale rather than foreclosing on the house. This means that you have to work with the lender. You will need to send them your current personal financial information and justify the reason for requesting a short sale. The short sale process will require significant follow up with the lender and interaction throughout the entire process.

can’t afford the property and that they are better off approving the short sale rather than foreclosing on the house. This means that you have to work with the lender. You will need to send them your current personal financial information and justify the reason for requesting a short sale. The short sale process will require significant follow up with the lender and interaction throughout the entire process.

Your lender will require bank statements, pay stubs, tax returns for the past two years, a letter of hardship explaining why you no longer can afford this home and any and all other information pertaining to your financial situation. Only after all of this information is reviewed and the lender performs their own evaluation of what the home is worth, will they make a decision on whether they will approve your short sale. It is common for homeowners to submit multiple offers from buyers before a short sale is finally approved by a lender (if at all).

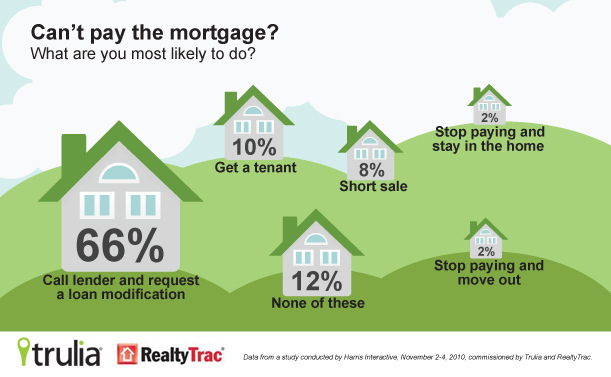

Statistics photo credit: truliavisuals via photopin cc

50 pence photo credit: bartmaguire via photopin cc