If you don't understand the language around loan modifications, you will be hopelessly lost and could end up not getting the result you desire. And the consequence of not getting a mortgage loan modification for many homeowners is foreclosure. So if you want to modify your home loan, take a little time to familiarize yourself with some of the language related to it. It gives you the best chance to get the result you want.

If you don't understand the language around loan modifications, you will be hopelessly lost and could end up not getting the result you desire. And the consequence of not getting a mortgage loan modification for many homeowners is foreclosure. So if you want to modify your home loan, take a little time to familiarize yourself with some of the language related to it. It gives you the best chance to get the result you want.

First, let's define loan modification. A loan modification is a permanent change to one or more terms of an existing mortgage loan, such as the interest rate, principal amount, or the time period over which the loan must be paid back, in order to make the payment more affordable. Loan modifications are usually pursued when options like refinancing are not available. Homeowners are required to show that they will be able afford their mortgage payment under the proposed modified terms by documenting their income and other debt. It takes a lot of work to apply for a loan modification, and complete applications are often denied and must be resubmitted. To have the best chance of a successful loan modification, it is recommended that homeowners work with a professional who has experience helping people in their situation. A law firm that provides foreclosure defense and loan modification assistance can help the homeowner to have as much time in their home as possible while pursuing a permanent solution.

Affordability: For loan modifications, affordability relates to whether or not the mortgage payments are within your financial means. For the modification to be approved, it must be affordable. Not being affordable is the most common reason for denial.

Debt-to-Income Ratio (DTI): The percentage of monthly gross income that goes toward paying debt.

Deferred Principal: When a portion of the principal owed on the loan is allowed to be repaid at a later date. If principal is deferred, it will be as part of an agreement to allow the homeowner to afford their house payments.

Dual-Tracking: When a bank considers a homeowner's application for a loan modification while pursuing foreclosure against them. Dual-tracking can result in the homeowner believing they are close to getting a loan modification, and then find out that foreclosure is imminent. The practice of dual-tracking has been restricted by CFPB rules.

Forbearance: When a lender agrees to hold back on foreclosure and allow a borrower to temporarily stop making, or catch up on payments.

HAMP: Home Affordable Modification Program. A government program to help eligible borrowers modify the terms of their mortgage loan. HAMP includes tier 1 and tier 2 programs.

Hardship: A difficulty that caused the homeowner to fall behind on their mortgage, such as being laid off from their job, experiencing a medical issue, or having a death in the family. Every loan modification application is required to have a hardship letter, our firm offers a

In-House Modification: An in-house modification is one that done by the lender alone and not through the government's HAMP program. In-house offers benefits because the lender can use any terms that they want and are not limited by HAMP's guidelines. In-house modifications are quicker, not limited to loans under a certain value, and offer fixed interest rates.

Investor: The investor is the entity that ends up owning and using your mortgage loan for the future cash flow stream that it is. The investor could be a hedge fund, pension fund, foreign government, or insurance company. One thing all investors have in common is that they want to make as much money as possible, so they will only accept a loan modification when it's clear that's more profitable for them than going through foreclosure proceedings.

Lien: A security interest over a property to secure payment. A lien on a property will need to be removed before a loan modification can be approved.

Loan-to-Value Ratio (LTV): The ratio of the value of a loan to the appraised value of the property it pays for.

Loss Mitigation: A process to avoid foreclosure where the lender tries to help a borrower who has been unable to make loan payments and is in danger of defaulting on the loan.

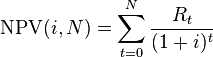

Net Present Value (NPV): The sum of the present values of incoming and outgoing cash flows over a period of time. When applying for a loan modification, homeowners will be given a net present value test that they either pass or fail. The test must be passed to be approved for a loan modification. When a servicer runs a NPV test, they are trying to determine whether it's more profitable in the long run to foreclose on the home and sell it to someone else or to modify the loan for the current owner. Many factors are taken into account, including the risk that the homeowner will default again and the cost of foreclosure.

Net Present Value (NPV): The sum of the present values of incoming and outgoing cash flows over a period of time. When applying for a loan modification, homeowners will be given a net present value test that they either pass or fail. The test must be passed to be approved for a loan modification. When a servicer runs a NPV test, they are trying to determine whether it's more profitable in the long run to foreclose on the home and sell it to someone else or to modify the loan for the current owner. Many factors are taken into account, including the risk that the homeowner will default again and the cost of foreclosure.

PITI: Principal, Interest, Taxes, and Insurance. If applicable, mortgage insurance and homeowners association fees are also included in PITI. PITI is what is typically called the mortgage payment, and all the major costs associated with owning a home, not including maintenance and utilities, are included in this figure and are made as one payment. PITI is important to banks when determining the affordability of a loan. Lenders compare the ratio of PITI to gross income and PITI plus all other debt to gross income to determine affordability.

Principal Reduction: A reduction in the principal owed on the mortgage loan, as allowed by the owner of the loan. Principal reductions cut back on how far underwater the home is, but banks will only agree to it under certain conditions and when foreclosing would be more expensive. The amount the principal is reduced by is treated like taxable income, sometimes called phantom income, unless it can be written off under the Mortgage Forgiveness Debt Relief Act of 2007.

Request for Mortgage Assistance (RMA): The application that a homeowner submits to request that the terms of their loan be modified. Along with the RMA, multiple other documents must also be included.

Remodification: Refers to modifying a loan that has been previously modified. As with the first modification, the borrower must resubmit all of the required documents, including tax and income statements, and a hardship letter. Homeowners who have defaulted on a HAMP tier 1 modification may apply for a HAMP tier 2 modification, but those with a previous HAMP tier 2 may not modify again.

Shared Appreciation Modification (SAM): A shared appreciation modification is one where the lender gives more favorable terms to the borrower, such as by reducing principal, in exchange for a getting a share of the increase in the value of the property when it is sold or refinanced. Ocwen Financial Corp has a SAM program where it writes down the mortgage to 95% of its market value, then forgives the amount written down over three years as long as the homeowner stays current. When the home is sold or refinanced, the homeowner must share one quarter of the appreciated value with the investor in the mortgage loan. Ocwen is only willing to give SAMs to homeowners when it is more profitable for them than foreclosing, and homeowners must qualify for the program.

Servicer: A loan servicer is the company that accepts payments from the borrower, credits the account, and initiates foreclosure proceedings. Servicers administer mortgages and have a lot of responsibility and power, so mistakes on their part have serious consequences.

Step Rate Plan: Terms of a mortgage where the interest rate starts low, and increases gradually over a period of time. Unlike an adjustable rate mortgage, which adjusts to market rates, a step rate plan changes according to a predetermined rate and time period.

Title Search: A check of public records to be sure that the seller is the recognized owner of the real estate and that there are no unsettled liens or other claims against the property. Unsettled liens would prevent loan modification.

Trial Modification Period: Before a permanent loan modification is granted, the borrower is required to make trial payments for several months to show that they are able to afford the loan and should be granted a permanent modification.