As 2015 comes to an end, those who watch and analyze the housing market are examining the data for the year and making predictions for the next. There is mostly good news, and as always with real estate it's all about the location. What really matters is what's going on in each homeowner's finances and life, and what options are available to them. So, let's look at some of the data for 2015 and the industry predictions for 2016 and see what it means for you.

As 2015 comes to an end, those who watch and analyze the housing market are examining the data for the year and making predictions for the next. There is mostly good news, and as always with real estate it's all about the location. What really matters is what's going on in each homeowner's finances and life, and what options are available to them. So, let's look at some of the data for 2015 and the industry predictions for 2016 and see what it means for you.

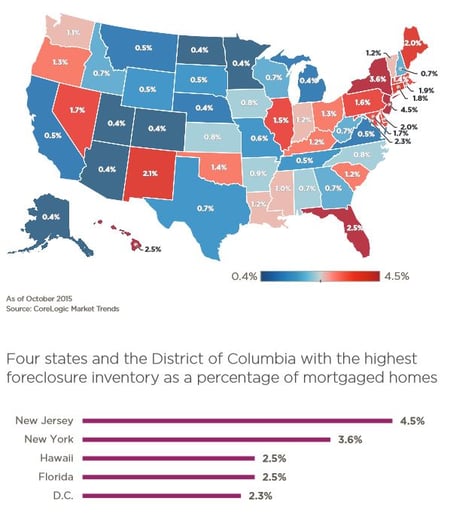

Home Prices Rise As Foreclosures Go Down

Some of the best news is that foreclosures continue to decrease. CoreLogic's National Foreclosure Report states that the number of homes in some stage of foreclosure for October is 463,000 or 1.2% of homes, which is an improvement from the 1.5% or 589,000 homes in October of 2014. But certain states have far more than their share of the foreclosure inventory. The state with the highest rate for October was New Jersey with 4.5%, followed by New York with 3.6%, and Hawaii and Florida with 2.5% each. Even though those states have an above average foreclosure rate, they're all lower than in the same period last year, and a continuation of a positive trend.

The decrease in foreclosure rates isn't the only positive. Home prices have been rising, the economy has continued to grow, and unemployment has also been steadily dropping. The consensus of analysts is that these positive trends will continue through the end of 2016, which is obviously good. However the rate of improvement may not be fast enough to make a meaningful difference to people who are really struggling, and there are headwinds as well.

Interest Rates Are Going To Rise

The Federal Reserve Bank is expected to raise interest rates before the end of 2015 and continue to gradually raise them through 2016. Higher interest rates will make it slightly more expensive to finance everything, including homes. But it's important to remember that current rates are historically low and any increase over the next year is likely to be so small that rates will still remain relatively low. CoreLogic's chief economist estimates that the interest rate on a 30-year fixed-rate mortgage will rise by half a percentage point by the end of 2016 to 4.5%, which is low and would still make owning cheaper than renting in many markets. The fact that buying can be cheaper than renting continues to be a big positive for the housing market.

One of the biggest factors for what the economy and housing market will do is what kind of wages American workers are earning. Hourly compensation rose by 3.4% in the third quarter of 2015 compared to the same period of 2014, when adjusted for inflation. But the Federal Reserve Bank's preferred method of measuring wages is the Employment Cost Index, and it shows that wages are basically stagnant. Even so, the continued improvement in the job market has given the Fed confidence to raise rates.

What Does It All Mean?

An improvement in national trends is nice, and it's great to hear that other people are struggling slightly less. But what people really want to know is how does it affect them specifically. It depends where you live, what you owe on your mortgage, what your home is worth, and whether or not you want to keep your home.

If your home is underwater and you're behind on your mortgage payments, you may feel like you have no options. But in fact, you do. Even doing nothing is a choice. First, you should decide whether or not you want to keep your home. If not, you can talk to your mortgage servicer to try for a short sale, or deed in lieu of foreclosure. Both options allow you to leave your home, but you should make sure that you get the bank to sign a deficiency judgment waiver so that you're not responsible for the deficient amount.

If you do want to keep your home after falling behind, and have enough cash, you may consider reinstatement. That's an agreement for the borrower to pay all of the past due amount plus interest and fees and allows them to get the loan back to normal. Obviously this is not an option unless the homeowner has that much cash available.

If you do not have the money to reinstate your mortgage loan after falling behind for a period of time, the best option to get back on track and lower the payment to an affordable level is through a loan modification, which is a permanent change to one or more of the terms of the loan. If approved, the monthly payment will be lowered to 31% of your monthly gross income. In some cases the amount of principal on the loan can be lowered, which reduces the borrower's negative equity.

Since the analysts seem to believe that home prices will continue to rise in 2016 and that buying will still be cheaper than renting, loan modifications are an especially attractive choice. They can give a homeowner an affordable payment and allow them to get by until their home is above water. Once the homeowner is out of negative equity, they can choose if they want to sell the home or not. And it's always good to have more choices when it comes to the biggest investment you will ever make.

Loan modifications are approved all the time, but most homeowners who apply without the help of a professional have their application denied. A few law firms focus their practice on providing loan modification assistance and foreclosure defense to distressed homeowners. The clients of those firms benefit from the experience that comes from practicing the specific area of the law that they need help with. It's hard to predict what any market will do, but taking actions that benefit you no matter what happens is a smart move.