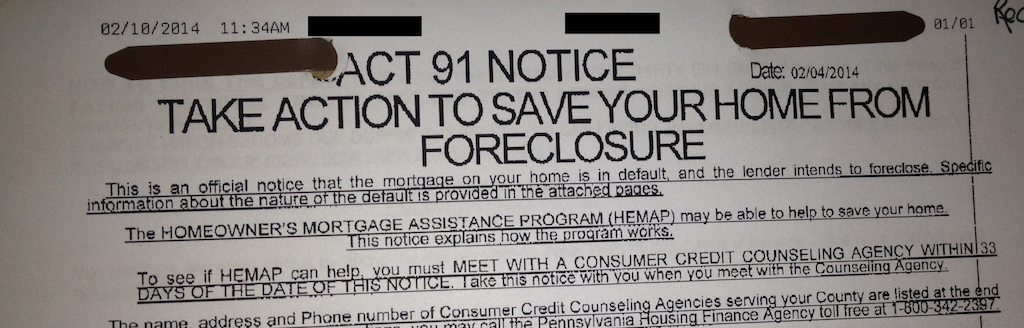

When you’re behind in your mortgage, it seems like your lender is playing mind games with you about auctioning off your home. Every day may be the day the lender wants to take your home without you knowing and sell it to the highest bidder. In Pennsylvania, a lender can’t foreclose on your home without letting you know and going through the proper steps. In 2012, Governor Tom Corbett restarted the Pennsylvania Homeowner’s Emergency Assistance Program (HEMAP) that included the Act 91 Notice. It was enacted years ago, but stopped in 2011 because of lack of funding.

[fa icon="clock-o"] Saturday, February 24, 2018 [fa icon="user"] Jake Sterling [fa icon="folder-open'] pennsylvania foreclosure defense, act 91 notice

Read More »

HAMP, the federal government's loan modification program, expired December 31, 2016, but we're still talking about it in 2018. Loan modifications remain a possibility for homeowners who need help avoiding foreclosure and keeping their home.

What Was HAMP?

In 2009, during the subprime mortgage crisis, foreclosures were happening at a rate not seen since the Great Depression. The Obama administration created HAMP to help struggling homeowners avoid foreclosure by modifying the terms of their loans to make them affordable.

HAMP provided guidelines for modifying mortgages and incentives for lenders to do so rather than foreclose. The program allowed for the term of the loan to be extended, the interest rate to be lowered, and the principal balance to be reduced or restructured so that the monthly mortgage payment was lowered to an affordable percentage of the borrower's current income.

[fa icon="clock-o"] Saturday, February 24, 2018 [fa icon="user"] Maxwell Swinney [fa icon="folder-open'] loan modification, HAMP, hamp loan modification

Read More »

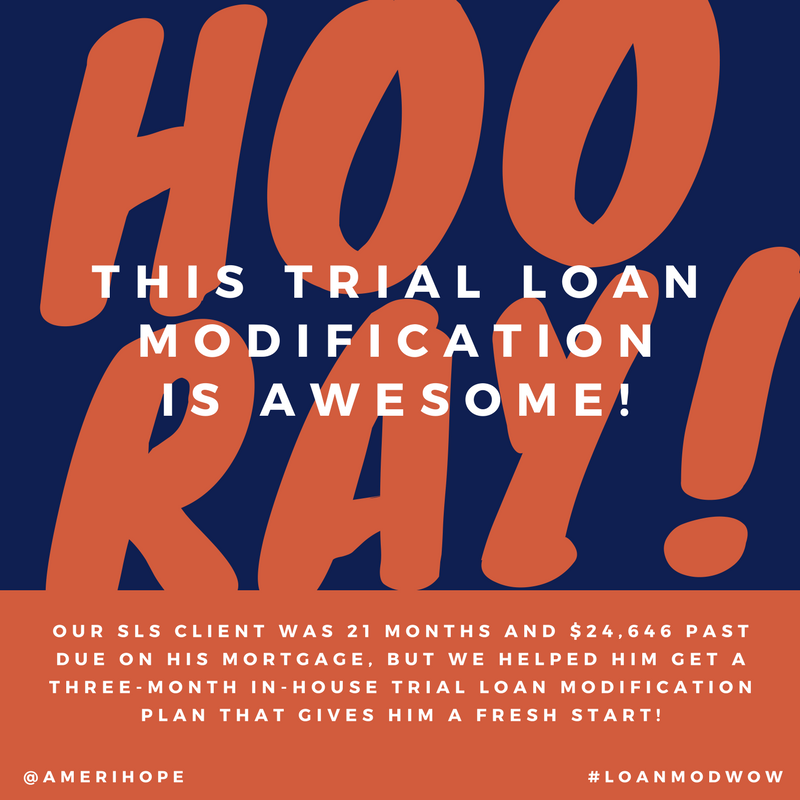

Disclaimer: These results should not be taken as a guarantee, as each case is unique. We have helped over 7,000 homeowners. Here are a some of their stories.

Every week we obtain loan modifications for our clients with a variety of loan servicers. You can see these results as they are announced on Twitter (#loanmodwow) or Facebook. Here are some of our results from this week with Seterus, Carrington, SLS, Penny Mac:

Seterus

Our Seterus clients were an unbelievable 91 months and $265,701 past due on their mortgage. We helped them get a final in-house loan modification with 3% lower interest rate, $471.53 lower monthly mortgage payment, and $149,666.01 interest-free deferment!

[fa icon="clock-o"] Friday, February 23, 2018 [fa icon="user"] Maxwell Swinney [fa icon="folder-open'] successful loan modifications, carrington loan modification, seterus loan modification, sls loan modification, penny mac loan modification

Read More »

A recent client of our law firm, who I'll call Mrs. McMillan to protect her privacy, hired us to help her elderly mother save her Florida condo from foreclosure.

Mrs. McMillan had power of attorney for her mother, who owned a beautiful condominium, worth more than $800,000, located on the water on the northern gulf coast of Florida. It has almost a half a million dollars in equity.

Usually our clients are being foreclosed on by the bank because they've missed mortgage payments, but our client's mother was facing foreclosure due to missed homeowner's association (HOA) payments.

Mrs. McMillan hired us in January of 2017, and shortly thereafter her mother passed away. Now she had to deal with the property for herself since she was the sole heir to her mother's estate.

Though she and her husband lived in Georgia, they did not want to lose the property. Their goal was to avoid foreclosure and keep the condo in the family if at all possible.

Mrs. McMillan and her husband, a doctor, were doing pretty well financially, and were able to pay the mortgage on the property. That kept the bank from trying to foreclose. But they didn't have full rights to the property and weren't able to pay all the past-due HOA fees to get out of foreclosure. It was going to take some work to fix that.

[fa icon="clock-o"] Wednesday, February 21, 2018 [fa icon="user"] Maxwell Swinney [fa icon="folder-open'] florida foreclosure attorney, foreclosure defense attorney, HOA Foreclosure

Read More »

Many people who want out of their timeshare get an unpleasant surprise when they try to sell it: they find that their timeshare is worthless. Despite what they were told before buying it, most timeshares just don't have a very good resale value. Why is that?

1. Timeshares are not a good investment.

Remember, with a timeshare, you don't own any physical property. You just own the right to use a unit in a building for typically one week a year. The average cost of buying that week from the resort developer is around $14,000 to $20,000, which is probably a lot more than it's worth. You likely won't be able to get anywhere near that much if you try to sell it on the secondary market.

2. There are other costs and fees.

The cost of the timeshare isn't the whole story. All timeshares also have maintenance fees that cost hundreds or thousands of dollars per year. And the fees increase annualy!

In 2012, the CEO and president of the American Resort Developer's Association, a trade organization that represents the timeshare industry, said that the average yearly maintenance fees for a one-week timeshare was $660.

[fa icon="clock-o"] Thursday, February 15, 2018 [fa icon="user"] Maxwell Swinney [fa icon="folder-open'] timeshare cancellation

Read More »

There is a wild beast lurking outside the door of many homes in America. Its name is foreclosure. For some homeowners it's not the first time they have encountered it. It came snarling and threatening to take their home from them once before, but they were able to drive it off with a loan modification.

Now the beast is back at the door, as dangerous and close as ever, and homeowners are wondering if a loan modification could be used to defeat it again.

Fortunately for distressed homeowners, loan modifications are not strictly one-time use. Having saved your home from foreclosure with a modification once does not automatically disqualify you from getting another.

[fa icon="clock-o"] Saturday, February 10, 2018 [fa icon="user"] Maxwell Swinney [fa icon="folder-open'] loan modification, housing market

Read More »

Disclaimer: These results should not be taken as a guarantee, as each case is unique. We have helped over 7,000 homeowners. Here are a some of their stories.

Every week we obtain loan modifications for our clients with a variety of loan servicers. You can see these results as they are announced on Twitter (#loanmodwow) or Facebook. Here are some of our results from this week with Rushmore, Penny Mac, and BB&T:

Rushmore

Our Rushmore clients were 62 months (5 years) and $120,007.45 past due on their mortgage payments and had been served foreclosure. We got them a three-month in-house trial loan modification plan with a fresh start and opportunity for a permanent loan modification!

[fa icon="clock-o"] Friday, February 9, 2018 [fa icon="user"] Maxwell Swinney [fa icon="folder-open'] loan modification, successful loan modifications, Rushmore loan modification, bb&t loan modification, penny mac loan modification

Read More »

If you've been fantasizing about canceling your timeshare, it's time to stop fantasizing and start making it happen. There are ways out of a timeshare, and Amerihope Alliance Legal Services may be able to help you.

Timeshares, also called “vacation ownership”, are sold to you as a good investment, but they really aren't. They don't appreciate in value like the salesperson claimed, and maintenance costs can rise considerably over time.

Many people feel that they were the victim of a timeshare salesperson's high-pressure sales tactics that coerced them into buying something they didn't want.

After purchasing a timeshare and experiencing what it's actually like to own, many people are disappointed and want a way out.

The good news is that owning a timeshare doesn't have to be a life sentence! You can get out and move on with life. Let's look at how that can be done:

[fa icon="clock-o"] Saturday, February 3, 2018 [fa icon="user"] Maxwell Swinney [fa icon="folder-open'] timeshare cancellation

Read More »

Disclaimer: These results should not be taken as a guarantee, as each case is unique. We have helped over 7,000 homeowners. Here are a some of their stories.

Every week we obtain loan modifications for our clients with a variety of loan servicers. You can see these results as they are announced on Twitter (#loanmodwow) or Facebook. Here are some of our results from this week with Ocwen, Penny Mac, SPS, Wells Fargo, and Carrington:

Carrington

Yes! Our Carrington client was $12,525 past due on his mortgage with a $1,201.72 monthly payment and 6.25% interest rate, now he has a final loan modification with $910.31 payment and 4.125% interest rate for monthly savings of $291.41.

[fa icon="clock-o"] Friday, February 2, 2018 [fa icon="user"] Maxwell Swinney [fa icon="folder-open'] wells fargo loan modification, successful loan modifications, ocwen loan modification, carrington loan modification, sps loan modification, penny mac loan modification

Read More »